If you’re a retiree in Canada and heard talk of a Canada $3800 October Payment, you’re not alone. Many seniors are searching for what it means, whether they qualify, and how to claim it. In this article I’ll walk you through the key details, using plain language, so you have a clear picture of what’s realistic and what to check.

In short, the Canada $3800 October Payment refers to a possible benefit or combined payment that eligible retirees might receive in October. We’ll review how this figure is derived, who may be eligible, what steps you need to take, and when to expect the money or find out you don’t qualify. This is informational and meant to help you navigate it with ease.

Canada $3800 October Payment

The Canada $3800 October Payment is getting a lot of attention, especially among retirees wondering if they’ll see a significant boost in their income next month. This payment isn’t a standalone benefit but rather a combination of several government programs like Old Age Security, the Guaranteed Income Supplement, and provincial top-ups. For some seniors, the combined amount of these payments in October can total up to $3,800. The exact amount depends on individual eligibility, age, income level, and whether tax filings are current. If you’re already enrolled in programs like OAS or CPP and have direct deposit set up, there’s a good chance your payments will arrive on time. This guide will help you understand if you qualify and what to expect.

Overview Table

| Item | Detail |

| Target Payment Date | October 2025, many benefit payments schedule around Oct 29 for seniors |

| Potential Amount | Up to around $3,800 for eligible retirees when combining pension + supplements + other supports (in some cases) |

| Major Programs Involved | Monthly pensions such as Old Age Security (OAS) and Canada Pension Plan (CPP) for seniors; also possible provincial benefit top-ups |

| Key Eligibility Factor | Age (65+), Canadian residency, filing of tax returns, low enough income for full pension/supplement, direct deposit set up |

| How to Claim | Mostly automatic if you already receive benefits; update My Service Canada / CRA account info, file 2024 tax return if required |

| When Payment Arrives | For OAS/CPP, Oct 29 2025 is listed in the official schedule |

Who Qualifies for the Payment

To stand a chance at the Canada $3800 October Payment, you’ll want to check several eligibility criteria:

- You must generally be 65 years or older if you’re relying on the OAS pension

- You should have lived in Canada for the required number of years to qualify. For OAS, you need at least 10 years of residence after age 18

- Your net world income for the previous tax year must be under a certain threshold to avoid a clawback. For example, for OAS in October-December 2025 the maximum monthly payable for ages 65-74 is $740.09 if income is under $148,451

- Your banking or direct deposit information must be up to date so the payment is deposited on schedule

- You should have filed your 2024 tax return because many benefits rely on that data

If you meet these and any other provincial or supplemental rules you could receive a combined benefit in October that includes your usual pension plus possible supplements, which gives the headline “up to around $3,800” though amounts vary widely.

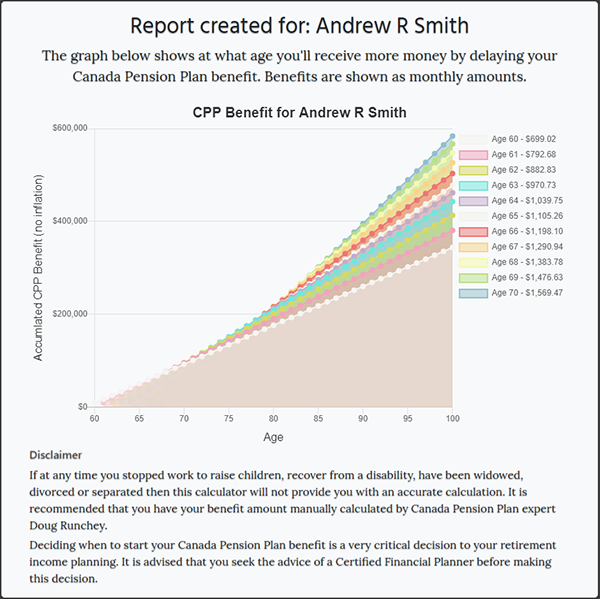

How the Payment Amount Is Calculated

The figure of $3,800 is not a fixed lump sum independent payment. Instead it’s an estimated maximum you might receive by October when combining:

- Your regular monthly pension or benefit for October (e.g., OAS or CPP)

- Any supplement or allowance you qualify for (e.g., GIS or provincial top-up)

- Possibly any one-time or additional benefit payments scheduled in October for which you qualify

For example: if your monthly pension is around $740 (for OAS) and you receive additional support, those amounts add up. While there is no official document specifically called “$3,800 October Payment,” many outlets use that figure as a general estimate for what eligible seniors may receive from combined sources.

Step-by-Step: Claiming the Payment

Here are the steps you should take now to prepare for the Canada $3800 October Payment:

- Log in to your My Service Canada or CRA account and ensure your banking information and direct deposit are correct

- File your 2024 tax return if you haven’t done so—many benefits depend on that

- Check your eligibility for OAS, CPP, and any supplements (GIS) if your income is modest

- If you qualify for any provincial top-ups depending on your province of residence, make sure you have applied or have your status updated

- Mark your calendar for Oct 29, 2025 (for OAS/CPP payments) and look out for direct deposit confirmation

- If you do not receive what you expected, contact Service Canada or CRA to verify there are no missing forms or suspended payments

Things to Watch Out For

- Don’t expect an automatic “$3,800 check” if you don’t meet eligibility. The amount varies

- Be wary of scams claiming “you must pay a fee to get this payment.” All legitimate benefit payments are processed by government portals, not third-party solicitations

- If you have a higher income, parts of your pension such as OAS may be clawed back. See thresholds

- Some benefits arrive via cheque rather than direct deposit and if you used mail, delays might affect timing

- Province-specific rules may change what support you’re eligible for so check your province’s program as well

Why This Payment Matters

The upcoming October payment for eligible seniors is important for several reasons:

- It gives you clarity on your expected income for the fall and winter months when costs tend to increase

- Knowing the date and amount helps you budget and avoid surprises

- Understanding your eligibility and status empowers you to ensure you’re not missing out on support you’ve earned

- It reinforces the value of staying up to date with tax filings and account information for government benefit system

FAQs

No, you must meet the eligibility criteria including residency, income threshold, and tax filings. The $3,800 is an estimate, not a guaranteed amount.

The expected date is around October 29, 2025. Check your bank account or government portal near that time.

You may miss eligibility for certain supplements or credits. File as soon as possible and ensure your CRA or Service Canada records are up to date.

Pension benefits such as OAS are taxable income, but some supplements or provincial credits may not be. Check with CRA or your tax advisor.

Log into your My Service Canada or CRA account and review your benefit notices. You’ll see what you qualify for and if there are changes.