Alright, let’s get straight into it: when it comes to student loan changes 2025, things are moving fast and if you have federal student debt, you’ll want to understand what’s ahead. These shifts aren’t just tweaks; they could significantly affect how much you pay, how long you pay, or even your strategy for managing your debt.

In this article I’ll walk you through the major regulation updates under these student loan changes 2025, explain how they impact you, and give you a clear overview of what actions to consider as the rules reshape. No fluff. Just straight talk and practical guidance.

Student Loan Changes 2025 – What You Should Know

The new student loan changes 2025 bring some of the most impactful updates in years. The federal government is adjusting repayment options, borrowing caps, and forgiveness timelines. Many income-driven repayment plans are being phased out, while a new system takes over. At the same time, graduate and professional students will face strict new borrowing limits that may affect how they finance their education. For new borrowers, relief options like deferment and forbearance will be harder to access. That means millions of students and graduates may find themselves paying more over a longer period, with fewer safety nets. It’s important to understand exactly what’s changing, who it affects, and how to protect yourself financially in the coming months.

Overview Table: Key Points of the Reforms

| Feature | What’s Changing | Why It Matters |

| Lifetime borrowing limits | New aggregate limits on federal student loans: e.g., $257,500 cap for many borrowers | If you’re planning grad or professional studies, you may hit cap sooner and be forced into private loans |

| Graduate/Professional loan caps | For new borrowers: masters/grad capped (approx) $100K, professional degrees up to ~$200K | Your graduate programme may cost more out of pocket or make you rethink borrowing |

| Repayment plan restructuring | Old income‑driven repayment (IDR) plans are being phased/rewritten under new law | Models you signed up under may change, affecting monthly payments and forgiveness time |

| Deferment/forbearance limits for future borrowers | Some relief options for new loans will shrink (e.g., fewer hardship deferments) | If you experience job loss or hardship, your safety net may be reduced |

| Timing & applicability | Many changes apply to new borrowers, but some affect everyone; effective dates vary (some July 2026) | Knowing your “borrower status” date matters for what rules apply to you |

Repayment Overhaul & Longer Forgiveness Paths

One of the biggest components of the student loan changes 2025 is how repayment plans will look going forward. Under the new law, the older income-driven repayment plans like IBR and PAYE may either be consolidated or replaced, and for many borrowers the forgiveness timeline could be extended.

What does this mean for you? If you were counting on having your loan forgiven after 20 or 25 years, you might now face a longer period or a less generous plan. Payments might increase, or you may pay for more years. This could translate to thousands more in interest and total cost. If you’re borrowing now or soon, it’s crucial to check exactly which plan you’re on and how the new rules apply to you.

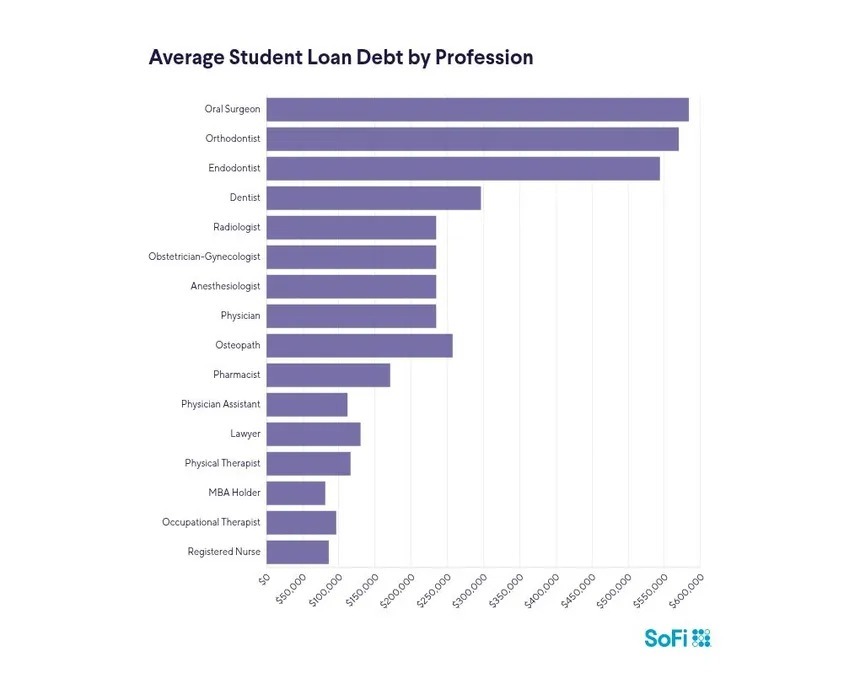

Borrowing Caps & Increased Risk for Graduate/Professional Students

Another major piece of the reforms deals with how much federal debt you can take on. The new caps mean that graduate and professional degree borrowers could hit federal limits faster and then need to rely on private loans with worse terms.

If you’re planning a law, medical, or business school, you should now budget for the fact that federal loan support might be less generous. That makes your return on investment calculation even more important. Also, hitting caps could impact your freedom to choose less-expensive schools or avoid large debt burdens.

Fewer Safety Nets for New Loans: Deferment & Forbearance

One less talked‑about but highly relevant change is how relief mechanisms are being revamped. The reforms restrict some of the generous deferment or forbearance options for future borrowers, especially those taking new loans after certain effective dates.

If you lose a job, face illness, or another hardship, your ability to pause payments or switch to a lighter payment plan might be harder. The shift moves more risk onto borrowers rather than the government. That means building a backup plan or emergency fund becomes even more important.

What You Should Do Right Now

Given the size and scope of these changes, here’s what I recommend:

- Review your current federal loans. Find out which repayment plan you’re on, what your forgiveness timeline is, and how the new rules might affect you

- If you’re planning to borrow, especially for graduate school, re-check your budget and consider how the new borrowing caps could affect you

- Stay informed about your borrower status and effective date: if you are a “new borrower” under the definitions, the rules that apply may be different

- Build a financial cushion. With fewer safety nets and longer repayment horizons, reducing other debt, saving a little buffer, or exploring income-based payment calculators can help

- Monitor communications from your loan servicer and the U.S. Department of Education. Because the field is shifting, staying updated will give you a leg up

FAQs

Some changes apply to everyone, while others apply only to new borrowers. Knowing your loan start date is key to understanding how these changes impact you.

It’s possible. With older IDR plans being phased out, the new system may calculate payments differently. Check with your servicer to review estimates.

Once you reach your federal loan cap, you’ll need to explore private loans, which often have higher interest rates and fewer protections.

The rules have passed into law and are in the process of implementation, but political changes in future could impact them.

For current borrowers, deferment is still an option. For new borrowers after certain dates, access may be restricted or shortened.