Millions of pensioners across the United Kingdom have been eagerly awaiting updates from the government about financial help to cope with rising costs. The Department for Work and Pensions (DWP) has now confirmed that a £2,500 one-off payment will be provided to eligible retirees in September 2025. This lump sum aims to support those struggling with soaring bills, food costs, and everyday expenses that have been eating into fixed pension incomes.

The Pensioner Bonus UK will be credited automatically to qualifying pensioners, with no applications required in most cases. If you or your loved ones rely on the state pension, this payment could provide essential relief. Below, we break down everything you need to know, from eligibility rules and payment dates to how the scheme works.

Pensioner Bonus UK: What Retirees Need to Know

The Pensioner Bonus UK is a one-time, non-recurring payment of £2,500 announced by the DWP. Unlike the Winter Fuel Payment or Pension Credit, this bonus is separate and does not affect other benefits. Payments will be made through the same system used for state pensions, ensuring quick transfers into bank accounts. Pensioners who receive their pension by cheque will also receive this bonus in the same way, though it may take a few extra days.

What makes this scheme particularly important is that it comes at a time when inflation has hit older citizens the hardest. Many retirees live on fixed incomes that do not stretch as far as they used to, and the £2,500 bonus is designed to provide financial breathing space. Let us look at the details in a clear snapshot.

Overview of the £2,500 Pensioner Bonus UK

| Topic | Details |

| Payment Amount | £2,500 one-off bonus |

| Announced By | Department for Work and Pensions (DWP) |

| Payment Start Date | Early September 2025 |

| Application Required | No, automatic for eligible pensioners |

| Eligibility Age | 65 or older by September 2025 |

| Residency Requirement | Must live in the UK and hold a National Insurance number |

| Payment Method | Direct deposit or cheque |

| Impact on Benefits | No effect on Pension Credit, Attendance Allowance, etc. |

| Taxable? | Usually tax-free but check if income threshold exceeded |

| Where to Check Status | Official gov.uk pension portal or DWP helpline |

What Is the £2,500 Pensioner Bonus?

The £2,500 pensioner bonus is a special payment created to support older residents dealing with cost-of-living pressures. Unlike regular pension increases or the triple lock guarantee, this payment is separate and not part of your standard pension entitlement.

The idea behind this bonus is straightforward: provide direct cash support to help cover essentials like heating, food, rent, or medical needs. With the energy market still uncertain and living costs continuing to rise, the bonus gives pensioners much-needed relief without affecting other entitlements.

Purpose Behind the Pensioner Bonus Scheme

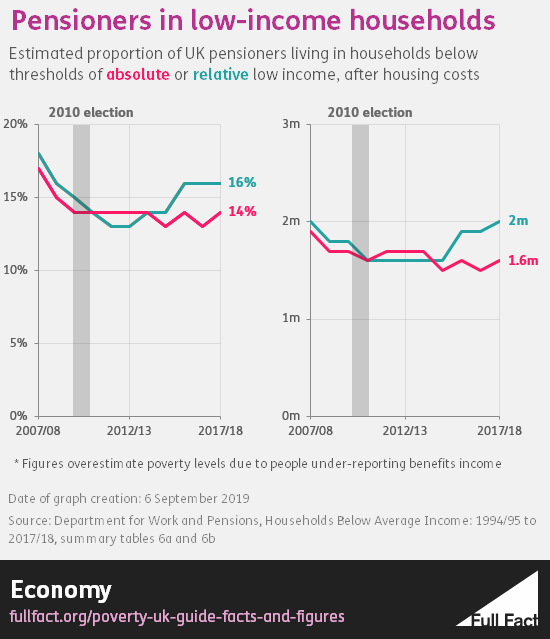

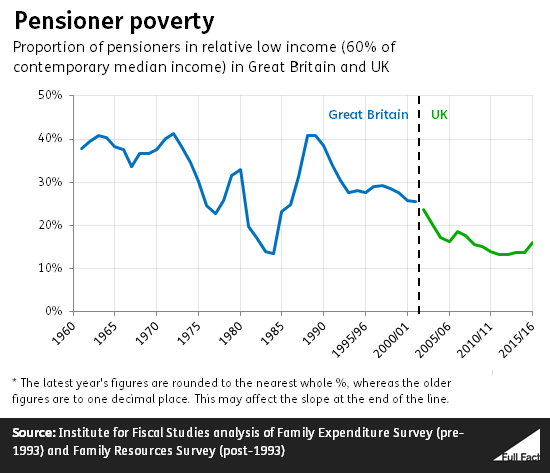

The government recognises that retirees are among the most financially vulnerable groups. While younger households may have additional income streams, pensioners often depend solely on their state pension. Inflation and higher utility bills have made it difficult for many to keep up with everyday expenses.

The Pensioner Bonus UK has been introduced to provide a safety net. It is not a loan or repayable credit but a one-time grant designed to reduce financial stress. By offering this payment, the DWP aims to protect older citizens from debt and poverty risks.

Who Is Eligible for the £2,500 Bonus?

To qualify for the bonus, you must:

- Be aged 65 or above by September 2025

- Be receiving the UK State Pension

- Be a UK resident with a valid National Insurance number

- Have an active bank account registered with pension services

Pensioners already receiving other forms of support such as Pension Credit, Attendance Allowance, or Disability Living Allowance will still qualify for the bonus. Since the payment is automatic, no separate application is required if your details are up to date.

How Will Payments Be Distributed?

Payments will be handled through the same system used for the State Pension. Most retirees will see the bonus paid directly into their bank account in September 2025. Those who still receive their pension by cheque will get the bonus in the same format, though delivery may be slightly slower.

- Payment Window: Early to mid-September 2025

- Method: Direct bank deposit or cheque

- Action Needed: None, unless banking details have changed

What If You Have Changed Your Bank Details?

If you have switched banks or updated your account recently, you need to notify the DWP before August 2025. Failing to update your records could result in delays. You can do this by:

- Logging into your State Pension account on the Government Gateway

- Contacting the DWP Pension Service helpline

- Visiting your local Jobcentre Plus for in-person help

Keeping your information accurate is the best way to make sure you get your payment on time.

How to Check If You Qualify

The government has set up an online tool for pensioners to check eligibility. You will need:

- National Insurance number

- Date of birth

- Pension reference number

Once entered, the system confirms eligibility and expected payment dates. This service is available on the official gov.uk website and is free to use at any time.

No Need to Apply for the £2,500 Bonus

Unlike some other government support schemes, there is no need to submit an application for this payment. The DWP will automatically process payments using the details they already have on file.

However, pensioners are advised to:

- Keep their bank details updated

- Monitor their accounts during September

- Contact DWP if payment is not received by early October

When Will the Payment Arrive?

The £2,500 bonus will start reaching pensioners in early September 2025. Most people should receive it by the middle of the month. If you have not received the payment by the end of September, you should:

- Wait 10 business days

- Double-check your banking information

- Call the Pension Service helpline for confirmation

Is the £2,500 Bonus Tax-Free?

For the majority of pensioners, the payment will not be taxable. It is treated as a one-off support payment. However, those with multiple income sources may need to confirm whether it pushes them into a higher taxable bracket. If you are unsure, check with HMRC or consult a financial advisor to stay compliant.

How the Bonus Helps Pensioners

The £2,500 bonus is expected to make a real difference to pensioners struggling with rising costs. For many households, this payment can cover:

- Heating bills for several months

- Rent or council tax payments

- Food and household essentials

- Healthcare or mobility expenses

By reducing financial stress, the bonus allows older citizens to maintain independence and dignity without falling into debt.

What to Do If You Do Not Receive Your Payment

If your payment has not arrived by late September:

- Confirm your bank details with the DWP

- Wait at least 10 business days after the expected date

- Use the gov.uk website or Pension Service helpline to report the issue

Once confirmed, the DWP will reissue missed payments promptly.

Warning About Scams and Fake Messages

Pensioners should remain cautious of fraud attempts. Common scams include:

- Texts or emails asking for personal or banking information

- Fake websites offering “applications” for the bonus

- Phone calls requesting money or codes

Remember, the DWP will never ask for sensitive details by text or email. Always use official government channels to check your status.

Impact on Pension Credit and Other Benefits

The good news is that the Pensioner Bonus UK will not affect other benefits. It will not reduce your Pension Credit, Winter Fuel Payment, or Attendance Allowance. This ensures pensioners can keep their current support while also receiving the bonus.

Final Thought

The Pensioner Bonus UK is a timely measure to help older citizens manage rising living costs. With no application needed and payments made automatically, it is one of the simplest forms of support provided by the government. By September 2025, millions of retirees will have an extra £2,500 in their accounts to cover essential costs.

To ensure you do not miss out, keep your details updated, check your account during September, and use official channels for updates. This payment could be a lifeline in challenging times.

FAQs

Anyone aged 65 or older, living in the UK, and receiving a State Pension by September 2025.

Payments will begin in early September 2025, with most pensioners receiving funds by mid-month.

No. The payment will be issued automatically if your pension details are up to date.

No. It is a separate payment and will not count as income for benefits.

Wait 10 working days, then contact the DWP or check via the official gov.uk pension portal.