As we move into the final months of 2025, millions of seniors across Canada are looking forward to their next CPP and OAS payment. These monthly pensions are vital for older Canadians who depend on a stable and predictable income. Whether it is covering rent, groceries, or healthcare costs, these payments offer the kind of financial peace of mind that retirees have earned after years of contribution and hard work.

Understanding when the CPP and OAS payment will arrive, how much it might be, and what could affect the amount is important for anyone currently receiving or planning to receive these benefits. In this guide, we break down everything you need to know about the October 2025 payment schedule, the amounts involved, and how these programs support Canadian seniors.

CPP and OAS Payment in October 2025

The CPP and OAS payment for October 2025 is scheduled for 29 October 2025, with both benefits processed on the same date for convenience. The Canada Pension Plan (CPP) is based on how much and how long you contributed during your working years. It is available as early as age 60. The Old Age Security (OAS) benefit, on the other hand, is age and residency-based, starting at age 65 for Canadians who have lived in the country for at least ten years after turning 18.

If you qualify for both, you can receive both payments together, either via direct deposit or cheque. Together, CPP and OAS can provide a combined monthly payment of up to around $2000, depending on your income, age, and contribution history. The October payment comes just ahead of winter, offering crucial financial help to many households.

CPP and OAS Payment – Overview Table

| Detail | Information |

| October 2025 Payment Date | 29 October 2025 |

| Next Payment Dates | 26 November and 22 December 2025 |

| Maximum CPP Payment at Age 65 | $1433 |

| Average CPP Monthly Payment | $848.37 |

| OAS Maximum Payment (Age 65–74) | $740.09 |

| OAS Maximum Payment (Age 75+) | $814.10 |

| OAS Income Threshold (Age 65–74) | Below $148,451 |

| OAS Income Threshold (Age 75+) | Below $154,196 |

| Combined Maximum Estimate | Up to $2000 per month |

| Application Requirement | Not required if already eligible |

What would be the October 2025 CPP & OAS Payment?

The amount you receive from your CPP and OAS in October 2025 depends on your eligibility and financial background. For CPP, the maximum monthly amount for someone retiring at age 65 is $1433, but most Canadians receive an average of around $848.37 per month. Your actual CPP payout will depend on how long and how much you contributed to the program while working.

OAS payments are adjusted quarterly, and for October through December 2025, the maximum monthly amount for seniors aged 65 to 74 is $740.09. Seniors aged 75 and older can receive up to $814.10, assuming their annual net income remains under the threshold. If your income is too high, you may see a reduction due to the OAS recovery tax.

When will you receive the October 2025 CPP & OAS payments?

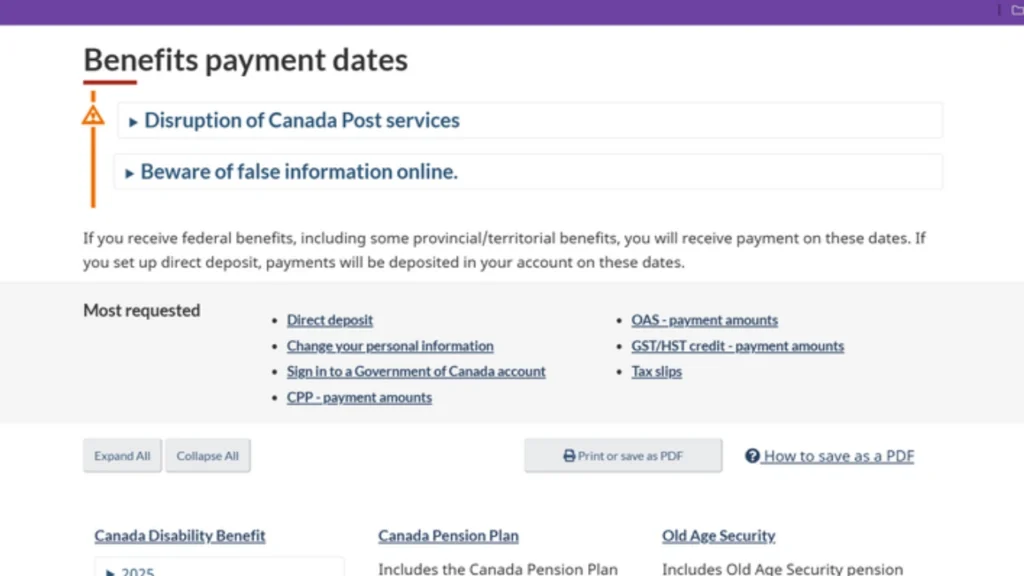

The CPP and OAS payment for October is expected on 29 October 2025, according to the official payment schedule shared by the Canada Revenue Agency. If you receive your payments through direct deposit, they should appear in your account that day. Those receiving cheques may experience delays, depending on their location and postal service timelines.

Here are the next few payment dates:

- October 2025: 29 October

- November 2025: 26 November

- December 2025: 22 December

This consistency helps seniors plan their monthly budgets and prepare for upcoming expenses, especially during the winter season when utility bills and healthcare costs may increase.

What can affect your CPP and OAS payments?

Several personal and financial circumstances can impact how much you receive from your CPP and OAS payment each month. It is important to stay informed about what might influence your benefit amount.

CPP Factors:

- If you continue working while receiving CPP, additional contributions may increase your benefit through post-retirement enhancements.

- If you go through a separation or divorce, your CPP credits may be split between you and your spouse.

- If you had low income years, the program may allow for the exclusion of up to 8 years of your lowest earnings, which can help raise your average.

OAS Factors:

- If your net income for 2024 is more than $90,997, a portion of your OAS may be clawed back through the recovery tax.

- Delaying the start of your OAS beyond age 65 can result in higher monthly payments when you do choose to start.

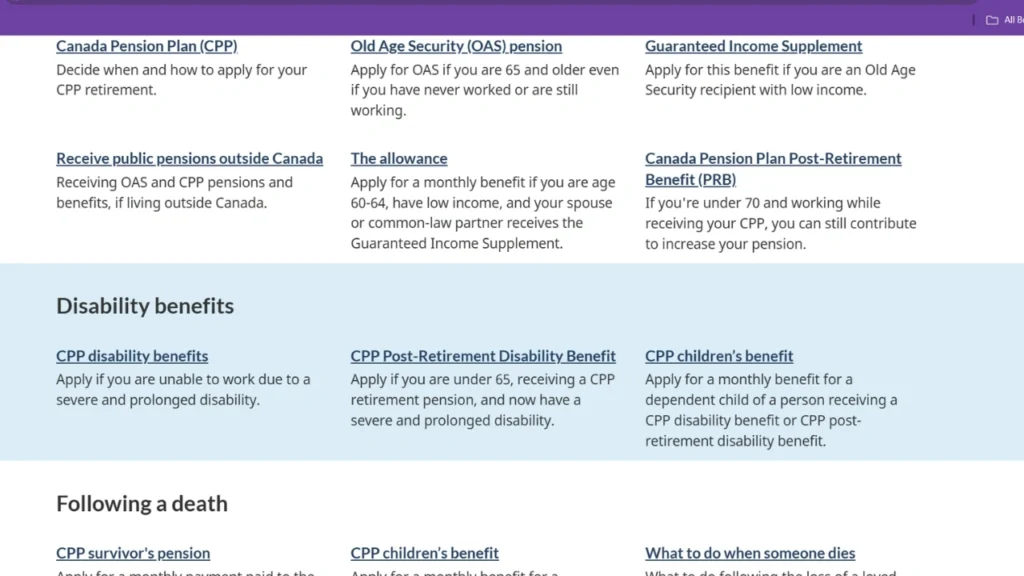

- You may also be eligible for additional benefits like the Guaranteed Income Supplement (GIS) or Allowance for Survivors, which can boost your overall income.

What should you do if you do not receive the pension on the scheduled date?

Missing your CPP and OAS payment can be stressful, but there are steps you can take to resolve the issue quickly. First, log in to your My CRA Account and review your payment status. If everything looks normal and the payment still has not arrived, you can follow up with the appropriate authorities.

Here is what to do:

- Contact Service Canada at 1-800-277-9914 during business hours (8:30 AM to 4:30 PM, Monday to Friday).

- Text their support line at 1-800-255-4786 for help with benefits.

- Visit a local CRA or Service Canada office if needed.

- Double-check your direct deposit and mailing information on file to ensure it is accurate.

Most payment delays are caused by outdated information or temporary postal issues, so keeping your account details current is key.

Final Tips for Managing CPP and OAS Benefits

Receiving your CPP and OAS payment consistently is one thing, but maximizing your benefits takes a bit of planning. Here are some helpful tips to keep your payments accurate and on time:

- Keep your CRA and Service Canada profiles updated with your latest address, banking info, and marital status.

- Monitor your net income to avoid any unexpected clawbacks on your OAS.

- Consider delaying OAS if you have other income sources and want to receive a larger monthly amount later.

- Explore whether you qualify for GIS or other low-income support programs if your total income is low.

With a little effort, you can make sure your retirement income works harder for you.

FAQs

1. When is the October 2025 CPP and OAS payment scheduled?

It is scheduled for 29 October 2025.

2. How much will I receive from CPP and OAS in total?

You could receive up to $2000 per month if you qualify for the maximum amounts under both programs.

3. Can I receive both CPP and OAS at the same time?

Yes, if you meet the eligibility for both, you will receive them together, often in a single deposit.

4. What if my payment does not arrive on time?

Check your CRA account, confirm your bank details, and call Service Canada for assistance.

5. Can I increase my CPP or OAS payments?

You can increase CPP by contributing more or delaying it. OAS can also be increased if you delay receiving it past age 65.

Final Thought

The CPP and OAS payment system is a crucial part of retirement planning in Canada. With the October 2025 payment landing on the 29th, now is a great time to double-check your details, understand how your payment is calculated, and make any updates if needed. These benefits exist to support you in retirement, and with a little attention, you can make sure they serve you well. If you found this guide helpful, share it with someone who could benefit from it and stay tuned for more updates on Canadian retirement support programs.