If you’re a Canadian senior aged between 60 and 70, the phrase CPP Boost October 2025 might catch your attention and for good reason. This potential uplift in your retirement income could make a meaningful difference in your budget, especially when costs are rising and every dollar counts. I want you to understand exactly what this boost means, whether you qualify, and how to act so you don’t miss out.

In this article I’ll walk you through the details surrounding the CPP Boost October 2025 announcement or rumour, what it could mean for you, how eligibility works, and the timelines involved. I’ll also provide a clear overview table summarizing key facts, discuss payment dates, eligibility factors, and practical steps you can take.

CPP Boost October 2025: What You Need to Know

The much-anticipated CPP Boost October 2025 could deliver a one-time payment of $1,599 to eligible Canadian seniors between the ages of 60 and 70. This initiative is reportedly designed to provide added support amid rising living costs. To qualify, seniors must fall within the target age group and meet certain CPP contribution and retirement requirements. The CPP retirement pension can start as early as age 60, with increasing benefits for those who delay until 65 or 70. This payment boost is expected to coincide with the regular CPP schedule in October, offering a timely benefit ahead of winter. If you’re part of this group, reviewing your contribution history and pension status can ensure you don’t miss out on this opportunity.

Overview Table: Key Facts at a Glance

| Item | Detail |

| Proposed boost amount | Around $1,599 one-time payment for seniors aged 60-70 |

| Target month | October 2025 |

| Core eligibility age | At least 60 years old and eligible under CPP rules |

| Standard CPP retirement age | Between ages 60 and 70 (you can start at 60, defer to 65 or 70) |

| Monthly maximum CPP amount (2025) | $1,433 monthly if started at age 65 in 2025 |

| Payment dates for 2025 | October 29, November 26, December 22 (for monthly CPP) |

| Work while receiving CPP | Allowed; contributions may continue until age 70 |

Eligibility Criteria for Participating in the Boost

To make the most of the CPP Boost October 2025, you’ll need to satisfy several eligibility rules. First and foremost, you must be at least 60 years old and have contributed to the CPP at least once in your working life.

If you’re between age 60 and 70, you’re in the eligible age band for this boost. But you also must apply for your CPP retirement pension if you haven’t already. The timing of your claim affects your benefit amount, and the boost is likely designed to complement standard CPP rules.

For example, if you started taking CPP early at 60 your regular monthly amount will be reduced, while delaying to 70 increases it.

In short: confirm your contribution history, your age band 60-70, and ensure your CPP retirement pension application is submitted or up to date.

How the Payment Date and Amount Work

According to sources, the payment date for this boost looks to be October 2025, aligning with the normal monthly payment schedule of CPP benefits. For instance, October’s regular CPP payment date is October 29, 2025.

The one-time amount cited ($1,599) would be in addition to your regular monthly CPP payment, meaning you could receive your usual CPP pension plus the boost. However, since this is a reported figure and not yet fully confirmed, it’s wise to treat it as a strong indication rather than a guaranteed figure.

Financially speaking, for seniors in the 60-70 age band, this could provide an extra cushion. But always consider your overall retirement income mix—CPP, savings, pensions, and other benefits.

Why This Boost Matters and What’s Behind It

You might wonder why the government is offering this boost now. There are a few key reasons. First, inflation and rising living costs are putting pressure on retirees. A one-time boost can help ease the burden for many seniors.

Second, the boost aligns with broader enhancements to the CPP including higher contribution rates and expanded replacement income over time.

Finally, focusing on the 60-70 age band makes sense because many Canadians begin or are in the early phase of drawing CPP around age 65. A boost here could improve retirement security at a critical time.

From the reader’s perspective: this boost isn’t just extra money—it’s part of a larger retirement income ecosystem. Knowing how it fits with your CPP timing and contributions matters.

Steps You Should Take Now

Here’s what you can do to position yourself to benefit from the CPP Boost October 2025:

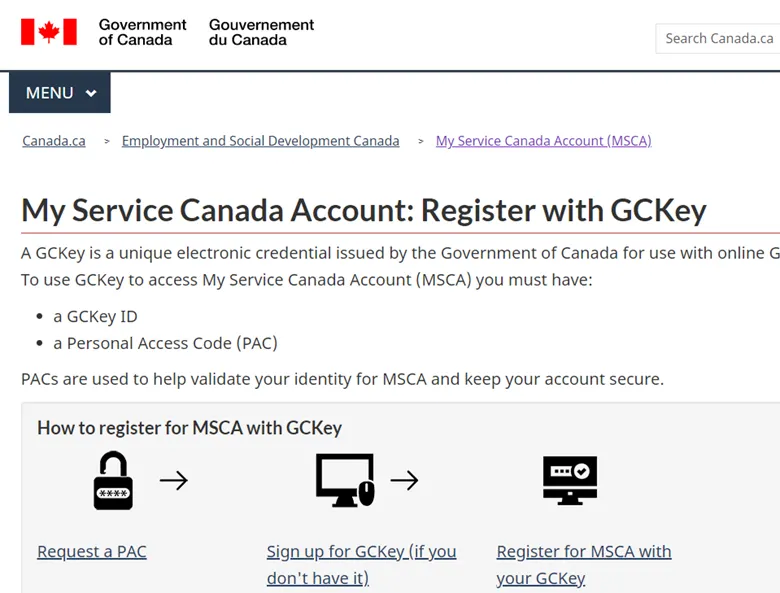

- Check your CPP Statement of Contributions – Log into your Service Canada My Service Canada Account and review your contribution history.

- Confirm your age eligibility – Are you between 60 and 70? If yes, you fall in the target band.

- Apply (or ensure you applied) for CPP Retirement Pension – If you haven’t, submit your application soon. CPP doesn’t automatically kick in.

- Set up Direct Deposit – Payments go faster and more reliably.

- Plan for taxes – CPP is taxable, so consider how this extra payment fits into your tax year.

- Stay alert for official confirmation – While the figure $1,599 is being cited in sources, wait for the official announcement and review any communications from Service Canada.

FAQs

No, the boost indicated for October 2025 appears to be a one-time payment rather than a permanent increase to your monthly pension.

If you delay your CPP until age 70, your monthly amount increases up to 42 percent more than starting at 60. This doesn’t necessarily affect the boost, but it does affect your overall benefit.

Yes, you can still receive CPP if you contributed while working in Canada, even if you live abroad. Check Service Canada guidelines for your country of residence.

It may influence your income-based benefits such as the Guaranteed Income Supplement (GIS). It’s wise to factor the boost into your overall income so you know its impact.

You’re allowed to work and receive CPP. If you’re under 70 and keep making contributions, you may qualify for the CPP Post-Retirement Benefit which adds to your regular pension.