Carbon Tax Rebate: The carbon tax rebate is one of those programs that many Canadians have heard about, but not everyone fully understands how it works or when to expect their payment. If you live in a province where the federal fuel charge applies, this rebate could mean hundreds of dollars back in your pocket each year. And with rising living costs, every little bit counts.

In this guide, we are diving into everything about the carbon tax rebate in 2026. From when the payments are scheduled to how much you might receive based on your location and household size, we are covering all the important points. You will also learn how to check your eligibility, where to track your payment, and why it is worth paying attention to this benefit.

Canada Carbon Tax Rebate 2026 Overview

Understanding the carbon tax rebate is key if you want to make sure you get your fair share from the federal carbon pricing system. The government designed this rebate to return a portion of what is collected through fuel charges directly to residents. It supports low and middle-income families, especially in provinces without their own carbon pricing plans like Alberta, Ontario, and Saskatchewan. Managed by the Canada Revenue Agency, it is issued quarterly, and most people get it automatically after filing their taxes. There is even an extra 10 percent added for those in rural communities who face higher heating and transportation costs.

2026 Carbon Tax Rebate Overview Table

| Key Information | Details |

| Program Name | Canada Carbon Rebate (CCR) |

| Managed By | Canada Revenue Agency |

| Payment Frequency | Every Quarter |

| Payment Type | Tax-Free Direct Deposit |

| Next Estimated Payment Date | January 15, 2026 |

| Provinces Eligible | Alberta, Ontario, Manitoba, Saskatchewan, PEI, NL, NS |

| Basis for Calculation | Household size and province |

| Extra Benefit | 10% Rural Supplement for qualifying households |

| Eligibility Requirement | Filed 2025 income tax and lived in eligible province |

| Application Needed | No, automatic after filing taxes |

Understanding the Canada Carbon Tax Rebate Program

The carbon tax rebate is the federal government’s way of giving back to households in provinces where the federal fuel charge applies. Since fuel prices increase due to carbon pricing, this rebate ensures that Canadians are not financially burdened by environmental policy. The key idea here is simple: polluters pay, and the money comes back to you.

Every three months, the government deposits a tax-free amount directly into your bank account. You do not need to apply. As long as you file your taxes and meet the residency requirements, you are in. It also makes a difference whether you live in a city or a rural area. Those in rural regions automatically receive an extra 10 percent, acknowledging their higher energy and travel costs.

2026 Carbon Tax Rebate Payment Schedule

The carbon rebate follows a quarterly payment schedule. The Canada Revenue Agency handles the distribution, and payments typically arrive around the middle of each quarter. While official 2026 dates are expected to mirror past years, here is the likely schedule you can follow:

- Winter Payment: January 15, 2026

- Spring Payment: April 15, 2026

- Summer Payment: July 15, 2026

- Fall Payment: October 15, 2026

If you are signed up for direct deposit, you should see the payment in your account on the exact date. If you receive cheques, allow a few extra days for delivery. It is always a good idea to double-check your CRA My Account before each payment date.

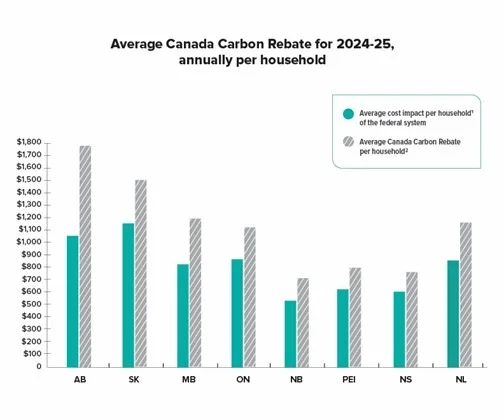

Canada Carbon Rebate Amounts for 2025

Although exact amounts for 2026 are not yet confirmed, we can use the 2025 payments as a reliable benchmark. The amount depends on where you live and how many people are in your family. Below is a breakdown of what was paid in 2025. Similar figures are expected for 2026:

| Province | Annual for Family of 4 | Quarterly Payment |

| Alberta | $1,544 | $386 |

| Saskatchewan | $1,504 | $376 |

| Manitoba | $1,200 | $300 |

| Ontario | $1,120 | $280 |

| Nova Scotia | $1,320 | $330 |

| Newfoundland & Labrador | $1,000 | $250 |

| Prince Edward Island | $900 | $225 |

There is also a rural supplement of 10 percent for those living outside major cities. This extra amount is added automatically if your address qualifies.

Eligibility Criteria for the 2026 Canada Carbon Rebate

The good news is that qualifying for the carbon tax rebate is not complicated. You do not need to apply. You just need to meet a few basic conditions:

- You were a tax resident of Canada at the start of the payment month

- You filed a 2025 income tax return

- You lived in one of the eligible provinces

- You are not claimed as a dependent by someone else

If you are new to Canada, your eligibility starts in the first full quarter after your arrival, as long as you file your return and submit any required forms like RC66 for child benefits.

How to Check Your CRA Payment Status

Wondering when your payment is coming or how much it will be? The CRA makes it easy to find out. Here is how:

- Log in to your CRA My Account

- Go to Benefits and Credits section

- Click on Canada Carbon Rebate

- Review your upcoming payment details and deposit info

If your money does not show up within 10 business days after the payment date, call the CRA’s benefit enquiries line. Double-check your banking details and address to avoid delays.

Why the Canada Carbon Rebate Matters

At a time when expenses are rising across the board, the carbon tax rebate puts money directly back into your hands. It is not just about climate policy. It is about fairness. You pay more at the pump or for heating due to federal carbon pricing, but you also get some of that money returned in cash.

Studies show that about 80 percent of households receive more in rebates than they pay in fuel charges. This makes the rebate a win-win: it supports climate goals without leaving families behind financially.

How to Maximise Your Rebate

If you want to get every dollar you are entitled to, make sure you:

- File your 2025 income tax return by April 30, 2026

- Enroll in direct deposit through CRA My Account or your bank

- Keep your family and address information updated

- Confirm that you are living in a province where the federal fuel charge applies

Missing one of these steps could delay or reduce your carbon tax rebate.

Carbon Rebate vs Other Federal Benefits

One of the best things about the carbon tax rebate is that it does not interfere with your other government payments. You can still receive:

- Canada Child Benefit (CCB)

- GST/HST Credit

- Canada Workers Benefit (CWB)

Each of these programs operates independently. So you can confidently collect your rebate without worrying about it affecting your other entitlements.

FAQs

The first 2026 payment is expected to arrive on January 15, covering the winter quarter for eligible residents.

No, the CRA automatically sends the rebate after you file your taxes and meet residency requirements.

Yes, as long as you live in an eligible province on the first day of the payment month, you qualify for that quarter’s payment.

It is an additional benefit for households outside major cities, added automatically if your address qualifies.

If eligible, the missed payment will usually be added to your next quarterly deposit after the issue is resolved.