If you’re searching for how to claim the Canada $1606 Disability Benefits Payment, you’re in the right place. This benefit offers financial support to eligible Canadians with disabilities, and knowing how to access it could make a big difference. In this article I’ll show you exactly how to claim the Canada $1606 Disability Benefits Payment, walk you through eligibility, timing and what you need to do.

Here you’ll find an overview of the program, a simple step-by-step guide, what the eligibility rules are, when to expect payment, and helpful tips to speed up your application. Whether you’re new to disability support or already receiving other benefits, this guide is aimed at making the process clear, friendly and actionable.

Canada $1606 Disability Benefits Payment: Eligibility & Timing

The Canada $1606 Disability Benefits Payment is part of a federal support program aimed at adults with disabilities aged 18 to 64. This monthly benefit is intended to provide financial relief to those already eligible for the Disability Tax Credit. Payments are expected to begin after the benefit application is approved, and in some cases, applicants may receive back payments dating back to June 2025. It’s important to understand that the actual monthly amount may vary depending on your income and family status, and not everyone will receive the full $1,606. To claim the benefit, you must meet all criteria including age, residency, DTC eligibility, and up-to-date tax filings. The benefit is paid monthly and is designed to work alongside other federal and provincial support programs.

Overview Table

Here’s a quick overview of the key facts you’ll want to keep in mind:

| Item | Details |

| Program name | Canada Disability Benefit (CDB) |

| Payment eligibility start | For months after May 2025, first payments in July 2025 if approved by June 30 |

| Maximum amount | Up to $2,400/year (approx $200/month) |

| Mentioned $1,606 amount | Specific payment figure that may apply in certain cases — verify your case |

| Age eligibility | 18–64 years old (and 65 in month you turn 65) |

| Required tax return | File 2024 tax return (and spouse/partner if applicable) |

| Disability Tax Credit (DTC) | Applicant must qualify for DTC first |

| Payment schedule | Third Thursday of each month after approval |

How to Apply for the Payment

Now let’s walk through the process you’ll follow to claim the payment. These steps cover what most applicants will need to do.

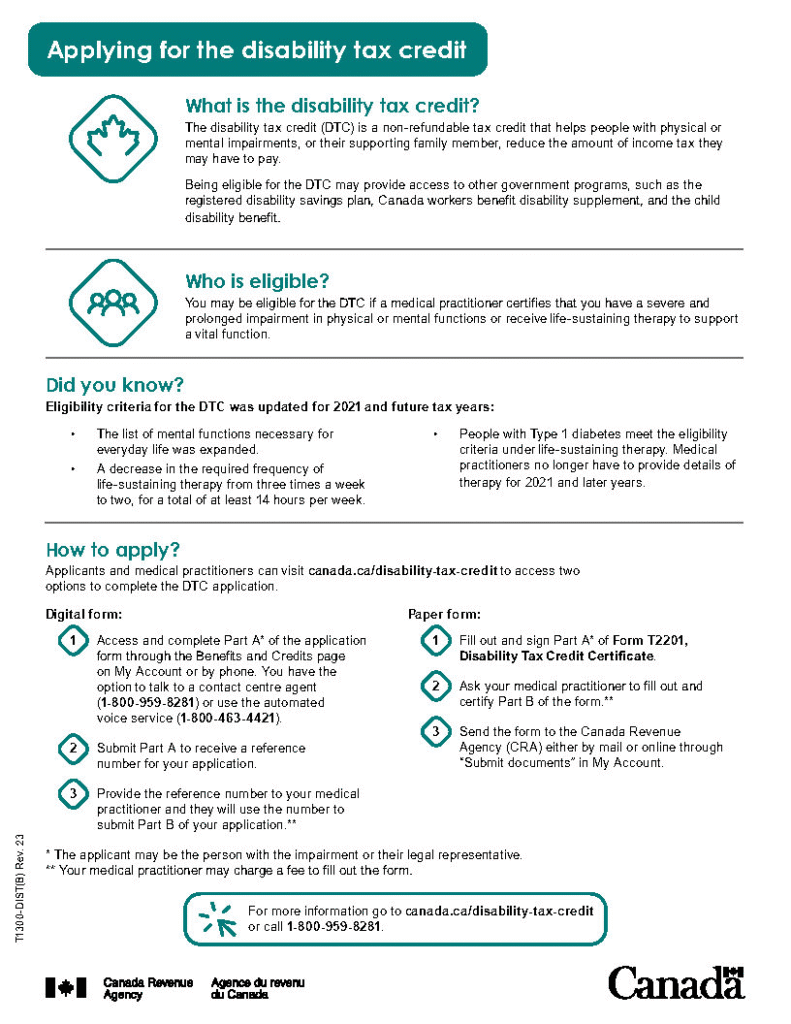

Step 1: Check DTC eligibility

First, make sure you are eligible for the Disability Tax Credit (DTC). The CDB is built on the DTC, so if you haven’t yet applied for or been approved for it, you’ll want to start there.

Gather any medical or supportive documentation required to apply for the DTC.

Step 2: File your 2024 tax return

Regardless of income level, you need to have your 2024 federal tax return filed (and if you have a spouse or common-law partner, their return too) to establish net income for the benefit calculation.

This will also determine your adjusted family net income which affects how much benefit you receive.

Step 3: Apply for the Canada Disability Benefit

Once you are DTC-eligible and have your tax return done, you can apply for the CDB. The online portal opened June 20, 2025.

Fill out the application form via the official website of Service Canada or submit any required documents. Make sure your Social Insurance Number (SIN) and identity documents are ready.

Step 4: Approval & timing

After submitting your application, most decisions arrive within about 28 calendar days.

If approved, payments begin the following month. For example, if you apply in June and are approved, you’ll get your first payment in July. Back-payments may be applied for up to 24 months, but not before June 2025.

Payments are issued on the third Thursday of each month. For example, November’s date is listed as November 20, 2025.

Step 5: Manage payments & ongoing eligibility

Once you are receiving payments, keep filing your tax returns each year and ensure you maintain your DTC status. Any change in household net income could reduce your monthly amount.

Also keep your banking and direct deposit details up to date for timely payments.

How Much Will You Receive?

Your monthly benefit under the CDB depends on income and other factors. The headline maximum is around $200 per month or about $2,400 per year for the 2025–26 payment period.

Here’s what affects the amount:

- Adjusted family net income: If your income is under a threshold, you may receive the full amount. Over the threshold means reduction begins.

- Working income exemption: A portion of employment or self-employment income is excluded when calculating the benefit.

- Household status: Whether you have a spouse or partner and whether they also qualify affects calculation.

Even though “$1,606” is mentioned in some communications, the official maximum amount used in regulation is around $200/month. If you see “$1,606”, be sure you check the details for your province or situation.

Common Mistakes to Avoid

To make the process smoother and avoid delays, watch out for these:

- Waiting too long to file your 2024 tax return. Do it early.

- Assuming approval of DTC is automatic or fast—start that process now.

- Missing the window: although back-payments up to 24 months are available, applying early always helps.

- Incomplete or missing documentation (identity, SIN, tax return, DTC approval).

- Not updating your banking information or address — this can delay payments.

FAQs

No. The amount you get depends on your adjusted family net income, whether you have a spouse or partner, and whether you meet all eligibility criteria.

If your application is approved by the end of a month, you should receive your first payment the following month, on the third Thursday.

You can still apply later and receive back-payments for up to 24 months from the date you apply, but not before June 2025.

No, it is a federal top-up and works alongside other supports. Some provinces may adjust your provincial benefits depending on how much you receive.

A portion of income from employment or self-employment is excluded when calculating your adjusted family net income. This means you may still qualify for full or partial benefit even if you work.