The Australia Aged Pension Increase has finally arrived, and if you’re among those living on the age pension, this is good news. Millions of retirees will see a boost in their fortnightly payment, helping to ease rising living costs and give you some breathing room.

In this post we’ll dive into the Australia Aged Pension Increase, explaining when the next payment lands, how much the rise is, what the eligibility requirements look like, and what you can do to make sure you’re prepared. You’ll get a clear snapshot of what’s changing now and what it means for you or someone you know.

Australia Aged Pension Increase

The latest Australia Aged Pension Increase reflects the government’s plan to help older Australians keep up with inflation and growing expenses. From 20 September 2025, pension payments will rise for both singles and couples. For single pensioners, the new maximum rate will be $1,178.70 per fortnight. For couples, each person will receive $888.50. Alongside these payment boosts, the income and assets test limits are also rising, meaning more people may qualify or see their pension increased. This change aims to support better financial stability for retirees and ease the burden of daily costs like rent, groceries, and healthcare. Staying informed now will help you plan ahead and get the most out of this update.

Overview Table

Here’s a summary of the key changes for the Australia Aged Pension Increase:

| Item | Detail |

| Effective date for new rates | 20 September 2025 |

| Maximum full pension – single | $1,178.70 per fortnight (≈ $30,646/year) |

| Maximum full pension – each in a couple | $888.50 per fortnight (≈ $23,101/year) |

| Assets test limit – single homeowner | $321,500 (for full pension) from 1 July 2025 |

| Assets test limit – couple homeowner | $481,500 combined for full pension from 20 Sept 2025 |

| Next potential indexation date | 20 March 2026 |

Why This Increase Matters

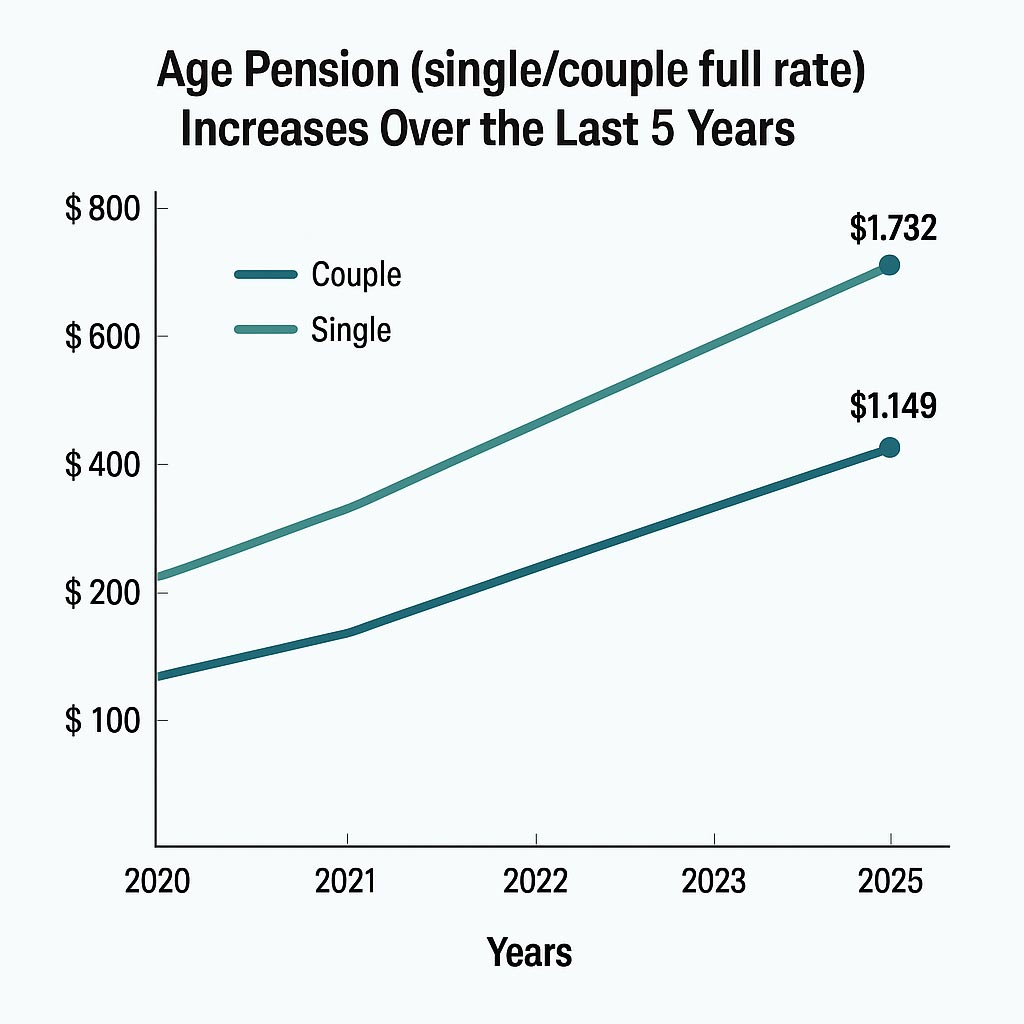

The cost of everyday living is on the rise as utilities, groceries, rent and services continue to creep higher. The Australia Aged Pension Increase aims to make sure that the payment keeps some pace with these pressures. The pension is indexed twice a year in March and September using factors like the Consumer Price Index, average weekly earnings and the Pensioner and Beneficiary Living Cost Index. In addition, by lifting the thresholds for income and assets tests, the government is giving more retirees the chance to qualify for the full or part pension rather than being phased out simply because their savings or work income nudged above older limits. That helps ensure the safety net is more inclusive.

Payment Timing: When Your Next Payment Drops

If you are already receiving the pension, you don’t need to apply again for this increase. The full rate should roll out automatically from the 20 September 2025 fortnight. For example, when the payment is processed for the period after this date, you should see the new higher amount in your bank account. Make sure your bank details are current with Services Australia and that you enrol for direct deposit if you haven’t already. Also check any supplementary payments you receive like energy supplement or pension supplement remain aligned. The Australia Aged Pension Increase covers the base pension amount and supplements.

Eligibility: What You Need to Know

Eligibility remains based on four key criteria: age/residency, the income test, the assets test, and ownership of the home (homeowner vs non-homeowner).

Income Test:

- From 20 September 2025, a single pensioner can earn up to $218 per fortnight before the pension begins to reduce.

- A couple combined can earn up to $380 per fortnight before reductions apply.

Assets Test:

- For a single homeowner, you must hold assets under $321,500 to qualify for the full pension.

- For part pension, the cut‑off is $714,500.

- For couples, the combined homeowner assets threshold for full pension is $481,500.

Residency/Age:

- You need to have reached the Age Pension qualifying age (currently 67 for many) and have sufficient residence in Australia, usually 10 years with 5 consecutive years.

With the Australia Aged Pension Increase, these eligibility rules remain but the thresholds have been updated so you might now qualify when previously you would not.

What You Should Do Now

- Check your upcoming payment schedule to ensure the new rate applies as expected.

- Review your income and assets. If you’re near the thresholds, small changes in savings or work hours might affect your pension.

- Update any personal details with Services Australia (bank account, address, partner status, etc.) to avoid delays.

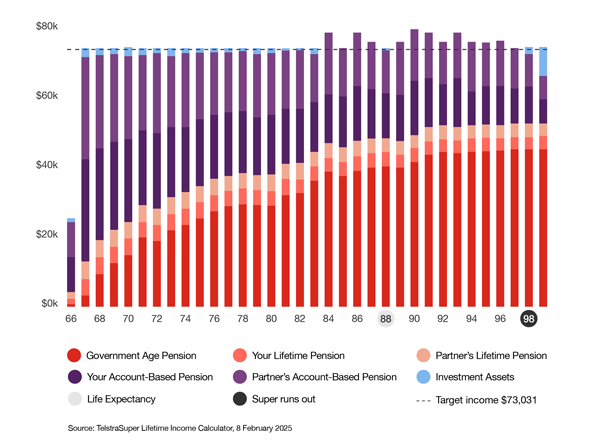

- Use an online pension calculator to estimate your potential payment under the new rates.

- If your income or assets change during the year (for example due to investment returns or work income) keep a record as this may affect fortnightly payments.

FAQs

The increase takes effect from the fortnight beginning 20 September 2025, with the new rates applying for that six-month period.

From 20 September 2025, a single person eligible for the full pension will receive $1,178.70 per fortnight, approximately $30,646 per year.

Yes. The income free area for singles is $218 per fortnight. If your earnings exceed that, your pension reduces by $0.50 per dollar.

Yes. From 1 July 2025, the assets limit for a single homeowner for full pension is $321,500. For part pension the limit is higher, up to $714,500. Couples’ combined limits also increased.

Possibly. The next indexation review date is 20 March 2026. Whether the pension increases again depends on inflation, wage growth and cost-of-living indexes.