If you’ve been hearing buzz about a “double pay”, you might be wondering if you’re in line for the Canada Revenue Agency (CRA) benefit described as the CRA Double Payment November 2025. The idea of getting two payments or an enhanced benefit in November 2025 naturally attracts plenty of attention. In this article I’m going to walk you through what’s real, what you need to know, and what you should do to check if you qualify.

Here’s the deal: this piece will cover the core concept of the CRA Double Payment November 2025, dig into payment dates, eligibility criteria, and the kinds of federal credits that may factor in. We’ll also highlight common questions you might have, and how to avoid being misled by false claims or scams. Let’s get started.

CRA Double Payment November 2025

The CRA Double Payment November 2025 refers to a situation where Canadians may receive two benefit payments in the same month due to timing overlaps or retroactive credits. For example, if the Canada Child Benefit is deposited on its regular schedule and another credit like GST/HST or provincial supplements arrives in the same period, the result feels like a double payout. This is not a new permanent benefit but a natural occurrence based on schedules. Understanding this helps families plan their budgets better. To benefit, you must ensure your tax filings are up to date and that you meet eligibility for the programs involved. Being aware of these details keeps you prepared and prevents confusion when deposits land in your bank account.

Overview Table

Here’s a quick overview of key federal benefit payment dates in 2025 that might impact whether you get a double payment or enhanced payout in November.

| Benefit Program | Typical Payment Date in November 2025 | Notes |

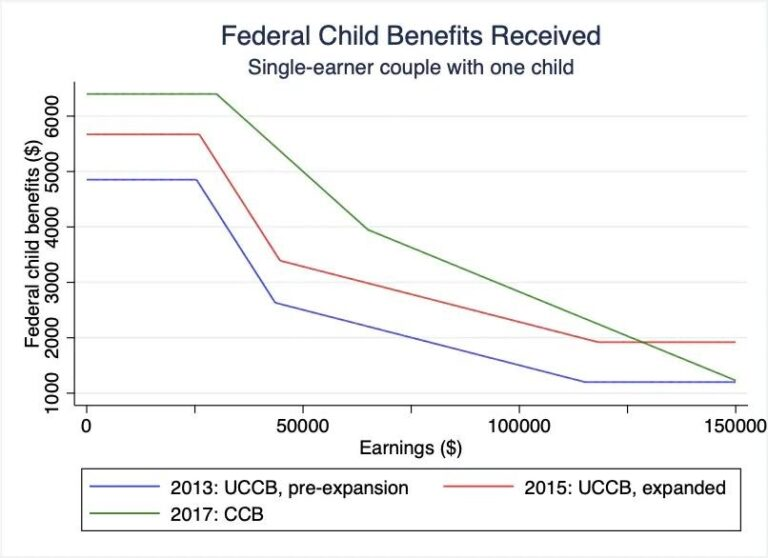

| Canada Child Benefit (CCB) | 20 Nov 2025 | Monthly payment for eligible families with children. |

| GST/HST Credit | No regular November monthly schedule (quarterly) | If timing lines up, may add an extra deposit. |

| Old Age Security (OAS) / CPP | 26 Nov 2025 (OAS) | Pension payments for seniors; could coincide with other credits. |

| Alberta Child & Family Benefit (ACFB) | 27 Nov 2025 | Provincial supplement, applies if you live in Alberta. |

Why a “Double Payment” Might Happen

There are two main reasons you might receive what looks like a double payment from the CRA in November 2025:

- Timing of payments: If a monthly benefit like CCB hits on 20 Nov and another benefit you’re eligible for also lands in November, you could see two deposits.

- Enhanced credit or catch up payment: Sometimes, due to tax filing delays or changes in your eligibility, the CRA may issue an extra or retroactive payment which lands in the same month as your regular benefit.

Eligibility Criteria to Check

When considering the CRA Double Payment November 2025 scenario, you’ll want to confirm a few things:

- You filed your 2024 tax return. CRA requires up to date tax filings for most benefit eligibility.

- You are a resident of Canada for tax purposes. Being eligible means you live in Canada and meet residency rules.

- You’re eligible for the specific benefits. For example, for CCB you must live with the child, be the primary caregiver, and meet income requirements.

- Your banking information is up to date. Direct deposit speeds payment while outdated info may delay it.

- No required action or update is outstanding. If CRA has asked you for verification, address updates or income changes, respond quickly.

What to Do Before the Payment

- Log in to your My Account on the CRA website and review your benefit and credits section for upcoming payments.

- Confirm your direct deposit banking details are correct.

- Check your filing status for 2024 taxes and make sure it is complete and accepted.

- Note any changes in your household, income, or dependents, and update CRA accordingly.

- If you live in a province that offers supplements like Alberta’s ACFB check their schedule since this might add a second deposit in November.

What to Watch Out For

- False claims or scams. Only trust official CRA websites or government updates.

- Mis timed payments. Two payments in November may just be a regular benefit plus a provincial top up.

- Expecting an extra payment when you’re not eligible. If you do not meet the requirements, you will not receive it.

- Over confidence in timing. Direct deposit dates can vary slightly due to bank processing times.

When Will the Payment Likely Arrive?

For many Canadians eligible for child benefit (CCB) the payment date for November 2025 is 20 November. If you also receive a provincial credit or another benefit that lands in the same month, you could see two deposits. This is why it’s often called the CRA Double Payment November 2025. Use the overview table to compare your benefit schedule with provincial supplements and plan your monthly budget.

FAQs

No. It depends on eligibility for multiple benefits and their timing. It is not a special program paid to everyone.

Log in to CRA’s My Account, ensure your 2024 tax return is filed, and check each benefit you receive such as CCB, GST/HST credit, or provincial supplements.

Yes, but filing delays may push payments into a later month instead of November.

Wait about 5 to 10 business days after the scheduled date. If it still hasn’t arrived, contact CRA to check for holds or missing information.

No. The phrase is used to describe the overlap of two payments in one month, not a brand new benefit program.