The talk about a $300 Canada Federal Payment has spread like wildfire across Canadian households in October 2025. Whether through social media threads, community groups, or YouTube finance channels, many people are buzzing about a supposed one-time $300 payment from the federal government. At a time when the cost of living continues to climb and household budgets are stretched, it is no surprise that this claim is capturing attention.

However, here is the truth: there is no officially announced $300 Canada Federal Payment scheduled for October 2025. Instead, what many Canadians are seeing in their bank accounts is the combined value of several scheduled federal benefit payments. This article will break down what is actually happening, explore the real benefits being distributed, and help you understand who is eligible and how to track your payments.

$300 Canada Federal Payment – Understanding the Confusion

The term $300 Canada Federal Payment has been widely misinterpreted. Contrary to what is being discussed online, there is no special one-time payment of $300 being rolled out by the federal government. The reality is that several legitimate benefit payments are being issued this month, and some Canadians are receiving more than one. That is where the $300 figure comes from.

For example, someone might receive their GST/HST Credit, the Advanced Canada Workers Benefit, and the Canada Child Benefit, all within the same month. If that person qualifies for two or more of these programs, the total deposit in their bank account can easily add up to $300 or more. This accumulation has led many to believe they have received a special bonus, when in fact it is a series of separate, pre-existing benefits.

What is important to understand is that each of these benefits serves a specific purpose and has its own eligibility criteria. If you are seeing multiple deposits, it is worth checking which programs you qualified for, instead of assuming you received a one-time federal bonus.

Overview Table: Federal Payments in October 2025

| Key Details | Information |

| Is the $300 payment real? | No, it is a combination of regular benefits |

| Official Government Confirmation | None as of October 2025 |

| Common Benefits Paid | GST/HST Credit, CCB, ACWB, CDB |

| GST/HST Credit Date | October 3, 2025 |

| ACWB Payment Date | October 10, 2025 |

| Canada Child Benefit Date | October 20, 2025 |

| Canada Disability Benefit | Paid monthly starting mid-2025 |

| Eligibility Based On | 2024 tax returns and personal circumstances |

| Direct Deposit Option | Yes, through CRA My Account |

| CRA Online Access | Use CRA My Account to check status |

What You Should Know About the $300 Pay Rumour

The $300 Canada Federal Payment rumor likely gained traction because of how these scheduled payments line up during the month. If you are receiving multiple benefits, the overlap might make it seem like a lump-sum bonus.

For example:

- A working parent with two children could receive the Canada Child Benefit and the Advanced Canada Workers Benefit in October.

- A person living with a disability who also qualifies for the GST/HST Credit and the Canada Disability Benefit could see a large total deposit as well.

This overlap in payments has occurred before, but the specific mention of “$300” seems to have created confusion in 2025. Several online posts and influencers have misrepresented these benefits, suggesting a one-time universal payout. The federal government has not issued any official statement confirming such a one-time $300 bonus.

That does not mean no help is available. Quite the opposite. These benefits are real and vital for many Canadians. Understanding them properly can help you manage your expectations and plan your finances more effectively.

Important Annually Scheduled Federal Payments of Benefits in October 2025

Let’s go over the key federal payments being made in October and how they relate to the $300 Canada Federal Payment conversation.

- GST/HST Credit

This is a quarterly payment provided to Canadians with low or moderate incomes to offset some of the sales tax they pay. For October 2025, the payment date is October 3. The amount varies depending on income and number of dependents. - Advanced Canada Workers Benefit (ACWB)

This benefit supports low-income workers. The second installment for 2025 will be issued on October 10. If you are employed but earn under a certain income threshold, you may qualify for this automatic payment. - Canada Child Benefit (CCB)

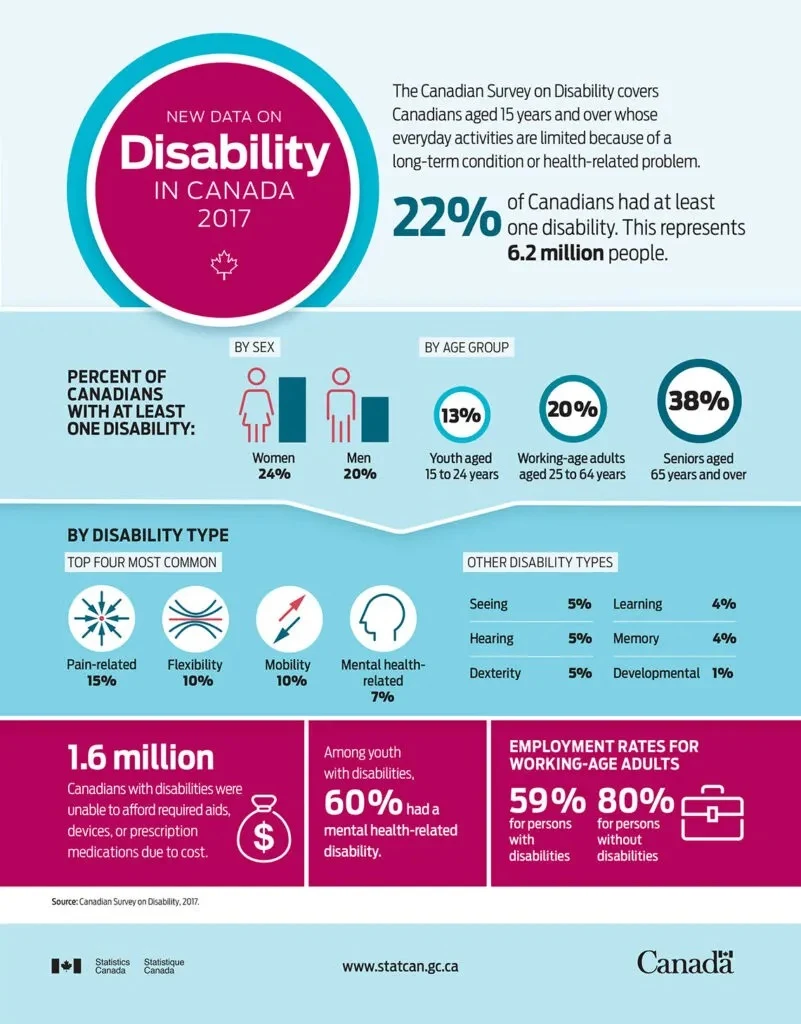

Families with children under 18 receive this payment monthly, with October 20 being the payment date for this month. The amount depends on household income and number of children, and it can be a significant part of a family’s monthly budget. - Canada Disability Benefit (CDB)

Launched in mid-2025, this monthly payment supports adults who qualify for the Disability Tax Credit. This benefit helps improve financial security for people living with disabilities.

These are the main sources of confusion around the $300 Canada Federal Payment, as many recipients of these programs can easily hit or surpass $300 across all benefits.

Qualification of These Benefits

Eligibility for any of these programs is tied directly to your 2024 tax return and your household situation. If your tax return is not up to date, you might not be considered for any of these benefits.

Here are some key factors that determine eligibility:

- GST/HST Credit: Available to low and moderate-income Canadians based on individual or family income.

- Advanced Canada Workers Benefit: Targeted at low-income workers who are earning a wage but not earning enough to cover living costs comfortably.

- Canada Child Benefit: You must have children under 18 and meet income thresholds. This benefit is automatically reviewed every year based on your tax filing.

- Canada Disability Benefit: You need to be approved for the Disability Tax Credit, which requires a formal application and approval process.

It is worth noting that most of these benefits do not require a separate application if you have already filed your taxes. The CRA uses your tax return to calculate and determine eligibility automatically.

How to Have Your Benefits Come Through

Even if you qualify for the programs mentioned above, it is crucial to follow the proper steps to ensure your money arrives on time.

- File Your Taxes on Time

The CRA relies heavily on your tax return to assess your eligibility for benefits. If you miss the filing deadline or enter incorrect information, your payments could be delayed or stopped entirely. - Sign Up for Direct Deposit

Direct deposit is the fastest and most reliable way to receive your federal benefits. You can set this up through your CRA My Account. - Check Your CRA My Account Regularly

This online portal allows you to view your benefit status, payment amounts, and upcoming deposit dates. It is the easiest way to stay informed. - Update Your Information Promptly

If your income, marital status, or number of dependents changes, you need to update this with the CRA. Failing to do so could lead to overpayments or missed benefits.

Taking these steps ensures you do not miss out on the payments that many are confusing with the $300 Canada Federal Payment.

FAQs

No. There is no special one-time payment from the federal government. What people are seeing is the combined total of scheduled benefit payments.

Common payments include the GST/HST Credit, Canada Child Benefit, Advanced Canada Workers Benefit, and Canada Disability Benefit. If you qualify for multiple, the total may be around $300 or more.

Log in to your CRA My Account. It shows your eligibility, upcoming payments, and any past deposits.

First, make sure your 2024 tax return was filed. Then, check that your information is up to date. If everything is correct and you still see no payments, contact the CRA directly.

Yes. If you qualify for two or more of the listed programs, your total amount could easily exceed $300. Each benefit has its own criteria and value.