Housing costs in Canada have been climbing steadily, and for many households, keeping up with rent or mortgage payments has become a monthly struggle. That is where the Canada Housing Benefit comes into play. This one-time, tax-free $500 payment, arriving in October 2025, is designed to offer immediate support to Canadians who are finding it hard to stay on top of their housing expenses.

Whether you are a renter facing rent increases or a homeowner juggling high mortgage payments, the Canada Housing Benefit could give you the breathing room you need. In this article, you will find a clear, detailed guide covering who is eligible, how to apply, and when to expect the money. It also explores how this benefit fits into the bigger picture of Canada’s housing challenges in 2025 and what you can do to make the most of this opportunity.

Canada Housing Benefit: Who It Helps and Why It Matters

The Canada Housing Benefit $500 payment is part of a targeted effort by the federal government to support low- and moderate-income Canadians impacted by rising housing costs. It is not a long-term subsidy but a one-time cash relief meant to ease financial pressure during a particularly tough housing climate. Both renters and mortgage-paying homeowners can qualify, as long as the property is their primary residence.

The payment is managed through the Canada Revenue Agency (CRA), and the application process is straightforward. What sets this benefit apart is its wide accessibility and the fact that it can be used flexibly, whether for rent, mortgage, urgent repairs, or utility bills. In a year where housing affordability continues to make headlines, this $500 payment may not solve the bigger crisis, but it can offer short-term stability to those who need it most.

Overview Table: Canada Housing Benefit $500 Summary

| Category | Details |

| Payment Amount | One-time $500, non-taxable |

| Benefit Type | Short-term financial relief for housing expenses |

| Payment Timing | Starts late September, continues through October 2025 |

| Age Requirement | 18 years or older |

| Residency Requirement | Must be a Canadian citizen or permanent resident |

| Housing Criteria | Must pay rent or mortgage on primary residence |

| Income Limit | Low to moderate-income households (thresholds vary) |

| Application Period | Opens early September, closes late October 2025 |

| Application Method | CRA My Account (online) or paper form by mail |

| Payment Delivery | Direct deposit or cheque (direct deposit preferred) |

What Exactly is the Canada Housing Benefit $500 Payment?

The Canada Housing Benefit is not a recurring subsidy. It is a one-time, tax-free payment of $500 provided by the federal government to help eligible Canadians with their housing costs. In a market where average rent for a one-bedroom apartment can easily top $2,000 in cities like Toronto or Vancouver, that $500 can make a real difference.

It can be used for a variety of housing-related expenses, including rent, mortgage payments, utilities, or urgent home repairs. The benefit is distributed by the Canada Revenue Agency (CRA), making it simple to apply through existing online accounts. The key goal is to provide immediate relief to households that are cost-burdened and struggling to make ends meet.

Who’s Eligible for This Payment?

Not every Canadian qualifies for the Canada Housing Benefit, and the government has laid out clear eligibility rules to ensure the payment reaches those who truly need it.

- Age and Citizenship: Applicants must be at least 18 years old and either Canadian citizens or permanent residents. Temporary visa holders and most non-permanent residents are not eligible.

- Income Thresholds: The benefit targets low- to moderate-income households. While income limits vary by region and family size, the goal is to prioritize those spending a large portion of their income on housing.

- Primary Residence Requirement: You must be renting or paying a mortgage on your main residence. Secondary properties or investment homes are not covered.

- Overlap with Other Programs: If you are receiving the GST/HST credit or Canada Child Benefit, you might already meet eligibility requirements or be pre-approved.

- Housing Hardship: Preference is given to those experiencing financial hardship due to inflation, unemployment, or rising housing costs.

When and How Will You Get the Canada Housing Benefit $500 Payment?

Getting your Canada Housing Benefit payment depends on applying early and accurately. Here is a breakdown of how the process works:

- Application Start Date: Early September 2025

- First Wave of Payments: Late September 2025

- Main Distribution Period: Throughout October 2025

- Application Deadline: Late October 2025

How to Apply:

- Log in to your CRA My Account portal.

- Fill out the housing benefit form with required documents (proof of rent or mortgage, ID, and income).

- Choose direct deposit for quicker payment. If that is not an option, a cheque will be mailed.

- Submit and track your application status.

It is highly recommended to apply as early as possible and use direct deposit to avoid delays in receiving your payment.

How to Make the Most of Your Canada Housing Benefit $500 Payment?

Once you receive your Canada Housing Benefit, here are a few ways to ensure it helps the most:

- Prioritize Essentials: Use the money toward current rent or mortgage due dates, or catch up on late housing bills.

- Cover Utilities: If your rent is paid, consider using it to pay electricity, water, or heating bills.

- Avoid Debt: Use the benefit to reduce reliance on credit cards or payday loans for basic housing expenses.

- Emergency Repairs: For homeowners, consider using the funds for minor but necessary home repairs.

- Plan Ahead: Even though it is a one-time payment, budgeting how you use it can stretch its impact.

Why This Payment Matters: Canada’s Housing Reality in 2025

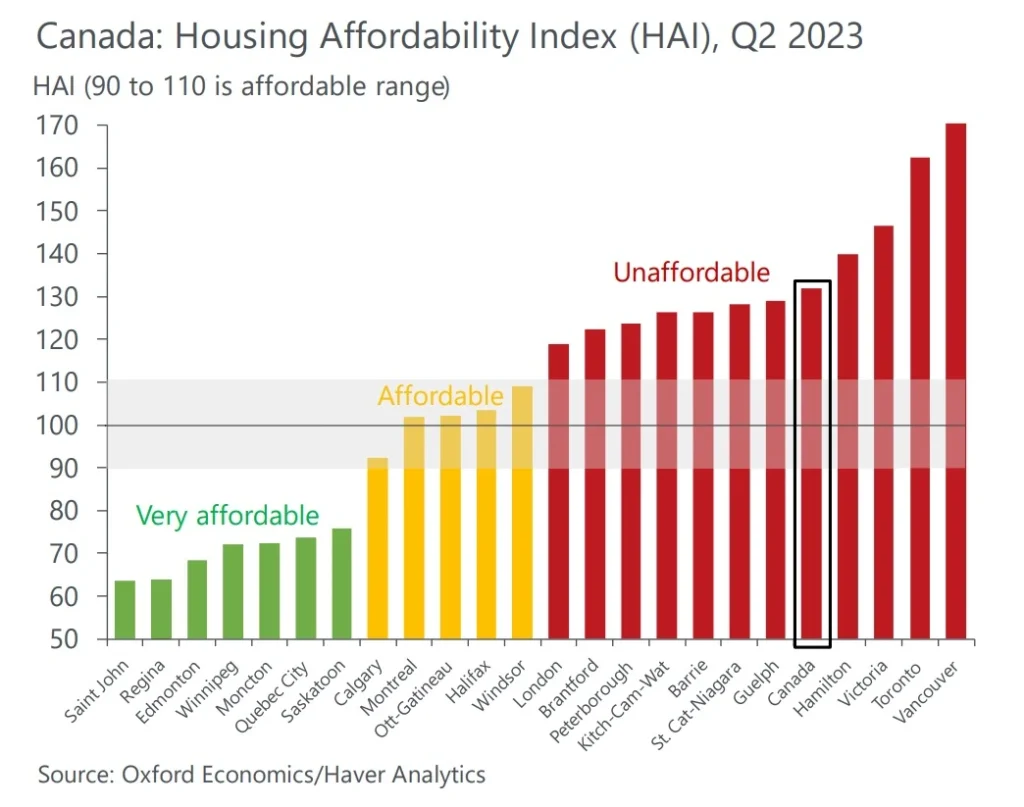

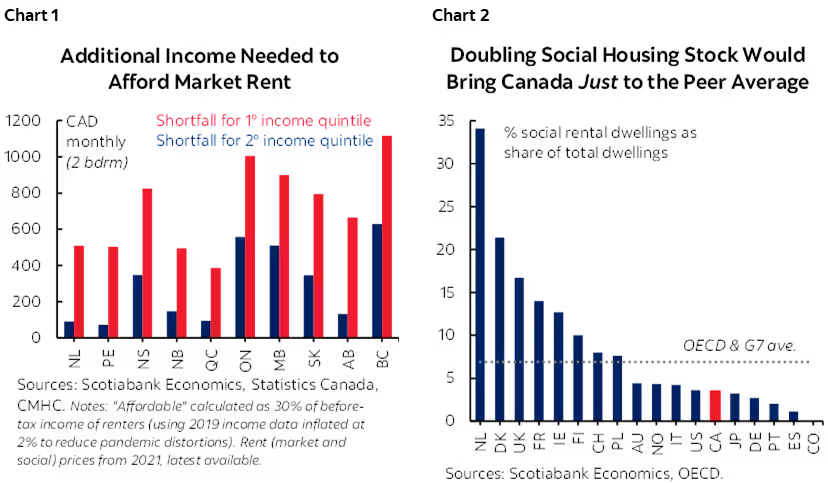

The Canada Housing Benefit is arriving at a time when housing affordability is at a critical point. According to recent data, roughly 30 percent of Canadian households are cost-burdened, meaning they spend more than 30 percent of their income on housing. For lower-income families, this often means sacrificing food, medicine, or transportation just to stay housed.

In cities like Calgary, Montreal, and Ottawa, housing prices have risen significantly over the past year. High interest rates and inflation have only made things harder. The $500 payment may not fix the system, but it is a timely response that provides immediate help to those falling behind.

The federal government’s larger housing strategy includes building more affordable units and increasing support through other long-term housing programs. This one-time benefit serves as a bridge while those long-term measures are still underway.

Success Stories: Real-Life Impact of Housing Benefits

Julie, a single mother from Calgary, used her $500 benefit to cover overdue utility bills, avoiding disconnection during a cold snap.

Abdi, a tradesman in Edmonton, said the benefit gave him just enough to stay current on rent after losing work for a few weeks.

The SoCheat family, living in Vancouver, said the housing benefit allowed them to afford a deposit on a safer apartment after living in unsafe conditions.

These are just a few of the stories showing how even a modest payment can create stability, reduce stress, and improve quality of life for Canadian families.

Final Thought

The Canada Housing Benefit $500 payment is a meaningful step toward helping Canadians navigate a tough housing landscape. If you qualify, do not miss the opportunity to apply. While it is not a permanent fix, it can offer much-needed relief right now. Take the time to check your eligibility, gather your documents, and apply through the CRA. With rent, mortgage payments, and utility bills rising, this benefit could be just the support you need to get back on track.

FAQs

No, it is a non-taxable, one-time payment and will not impact your other federal benefits.

Yes, as long as you are paying a mortgage on your primary residence.

You can register for one or request a paper application by mail, although that may delay your payment.

Income thresholds vary, but generally target low- and moderate-income households. CRA will guide you based on your previous tax filings.

No, applications close in late October. Missing the deadline means you will not receive the benefit.