This Rare Mineral Is Now More Valuable Than Gold: Ever heard someone brag, “Gold is king!”? Well, hold onto your cowboy hats because there are minerals out there today that blow gold right outta the water—both in price and in real-world demand. That’s right, the hottest commodities on Wall Street and Main Street ain’t always gold anymore. In fact, some rare minerals have now become more valuable than gold, and the reason behind their jaw-dropping prices will truly shock you. Let’s break it down, American-style, so that even your ten-year-old nephew or your neighbor’s Labrador could understand why folks are losing sleep over elements they can’t even pronounce.

This Rare Mineral Is Now More Valuable Than Gold

In 2025, rare minerals like rhodium, californium, and palladium have surged beyond gold in value due to their unique roles in technology, medicine, and clean energy. While these minerals are powering America’s innovation engine, their extraction comes with serious environmental and ethical challenges. Balancing demand, sustainability, and geopolitics is shaping the future of not just the mineral market but global industry and environmental health. Staying informed and engaged can unlock opportunities, whether as an investor, professional, or conscious consumer.

| Topic | Data & Stats (2025) | Industry/Career Info | Source/Reference |

|---|---|---|---|

| Most valuable mineral | Californium: ~$750M/oz, Rhodium: >$4,650/oz | High demand in tech, automotive, nuclear | JagranJosh |

| Gold price | ~$1,900/oz (2025) | Used mostly for jewelry/investment | Gold.org |

| Why the price explosion? | Scarcity, demand for electronics & cars | Careers booming in mining, tech | PMAC Asia |

| Key U.S. player | Demand from Silicon Valley and Detroit | Mining, recycling, R&D jobs | USGS.gov |

Gold’s Long-Standing Reign – And Why It’s Changing

Gold’s been the ultimate symbol of wealth and safety for thousands of years. From ancient Egyptian pharaohs to Wall Street investors, gold’s shiny appeal has meant power and security. But fast forward to 2025, and we’re living in an age defined by smartphones, electric cars, green energy, and rocket ships. These modern marvels all rely on minerals and rare elements far rarer and more valuable than gold for their high-tech guts.

Think of it like this: gold is the king of bling, but these new elements are the kingmakers behind how our world actually works today.

The Rock Stars of the Mineral World

Here’s the lineup of minerals that’ve stolen the spotlight:

- Californium (Cf): Like that rare VIP backstage pass, Californium is mostly created in labs, used in cancer treatment and nuclear science. Price tag? An eye-popping $750 million per ounce.

- Rhodium (Rh): Often hanging out with its platinum pals, it’s crucial in cars to reduce emissions, pushing over $4,650 an ounce.

- Palladium (Pd): Once overshadowed by platinum, this mineral is now a darling in catalytic converters, valued at around $1,022 per ounce.

- Iridium (Ir): Known for its incredible resistance to heat and corrosion, used widely in aerospace, hitting roughly $4,725 an ounce.

- Platinum (Pt): The luxurious heir to gold’s throne in jewelry and diesel engines, fetching about $1,005 an ounce.

So why the crazy price hike? It boils down to two big reasons: industrial demand and extreme scarcity.

Why the Price of This Rare Mineral Has Skyrocketed?

Industrial Boom

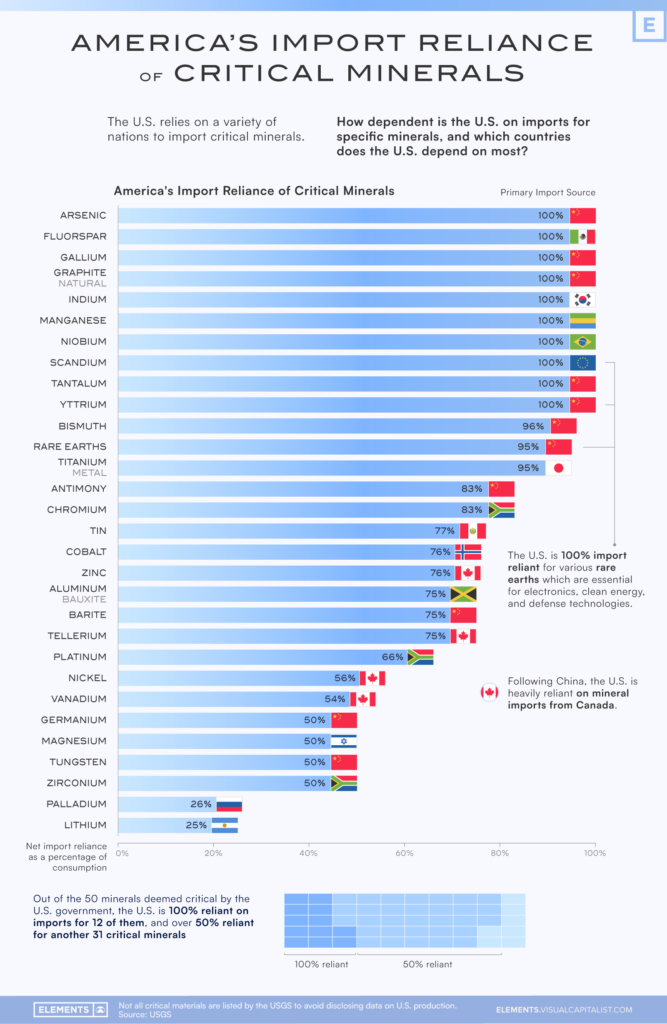

From Silicon Valley to Detroit, tech and automotive industries are gobbling up these minerals at breakneck speed. Electric vehicles use rare earth magnets and battery components made from some of these materials. Plus, solar panels, LCDs, wind turbines, and even medical radiation machines need them.

Scarcity

Unlike gold, which is found in relatively bigger quantities worldwide, many of these minerals are rare with limited mining sites. Imagine trying to fill a 1000-gallon gas tank using just a teaspoon—that’s how mining these rare elements sometimes feels.

Geography and Politics

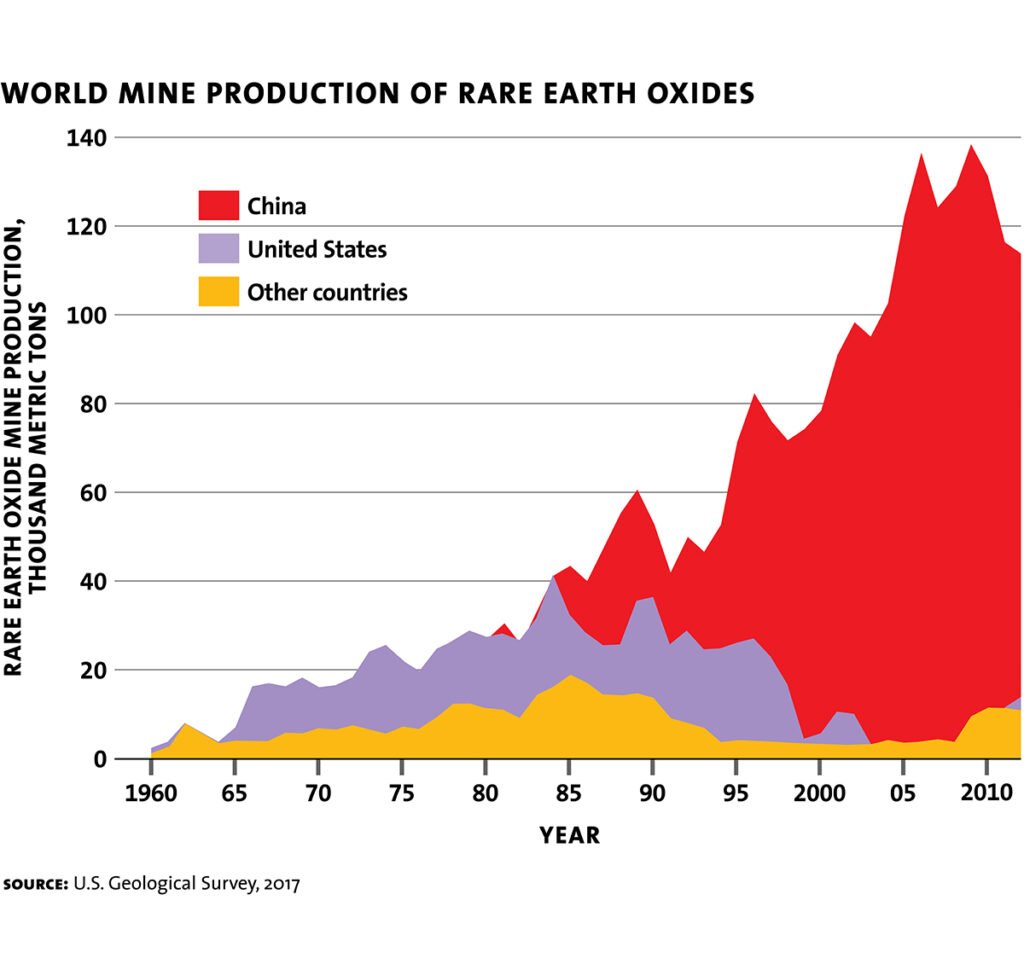

A significant chunk of these minerals are mined in politically sensitive areas or countries like China and South Africa. Export restrictions, trade wars, and environmental regulations contribute heavily to price instability.

Environmental and Ethical Impacts of Mining

While the rush for these minerals is fueling technological leaps, there’s a darker side that doesn’t get talked about enough: environmental damage and ethical concerns.

How Mining Harms the Environment

Rare earth element (REE) mining often involves removing large amounts of topsoil and creating toxic leaching ponds filled with chemicals such as ammonium sulfate. These chemicals, if not managed properly, can leak into groundwater and pollute air, soil, and nearby ecosystems. The mining process creates mountains of toxic waste; for every ton of rare earths produced, roughly 2,000 tons of toxic waste are generated. This waste often contains radioactive elements like thorium and uranium, which pose serious health risks.

Open-pit mining also disrupts habitats and can lead to soil erosion, water contamination, and destruction of biodiversity-rich areas—sometimes impacting indigenous communities who depend on the land.

Real-World Examples of This Rare Mineral Is Now More Valuable Than Gold

- In China’s Bayan’obo mining district, pollution has severely damaged vegetation and contaminated surface water and farmland.

- The Mountain Pass rare earth mine in California experienced wastewater spills that raised cancer risk concerns due to radioactive contamination.

- Similar ecological impacts have been observed in Australian and Canadian mining operations, sparking global calls for more sustainable practices.

Move Toward Sustainability

Efforts to reduce this environmental toll include:

- Improved waste management and reclamation techniques.

- Greater regulation and oversight to protect ecosystems and communities.

- Recycling of rare earths from old electronics to reduce mining.

- Research into alternative materials to minimize dependency.

The U.S. and European governments are stepping up with policies and funding to ensure mining is cleaner and that supply chains are more secure and ethical.

The Climate Change Connection: Minerals for a Greener Future

As the world fights climate change, clean energy technologies depend heavily on these rare minerals:

- Electric vehicles need materials for powerful magnets and batteries.

- Solar panels and wind turbines require rare earths for efficiency.

- Energy storage solutions and smart grids utilize specialty metals to keep the lights on cleanly.

But the push for green tech ironically creates a “catch-22” — mining these minerals causes environmental damage, yet they’re essential for reducing global carbon footprints.

The U.S. Mineral Strategy: Reducing Dependence

The U.S. is actively investing in:

- Domestic mining projects to reduce reliance on foreign sources.

- Research partnerships to innovate cleaner extraction and processing.

- Expansion of recycling programs to recover valuable metals from waste.

- Workforce development to prepare future experts in mining, materials science, and environmental stewardship.

There’s a growing ecosystem of startups and established companies in Silicon Valley and the Rust Belt working on everything from supply-chain transparency to green mining tech.

Your Everyday Connection

You might not realize it, but these rare minerals touch your life daily:

- Your smartphone screen uses indium tin oxide to stay sharp and responsive.

- The car you drive has catalytic converters with rhodium and palladium reducing harmful emissions.

- Medical devices and treatments rely on iridium and californium for precision and effectiveness.

- Even renewable energy systems made possible by these minerals are powering your community.

Practical Advice: Investing and Career Opportunities

For Investors

Direct purchasing of rare minerals isn’t easy, but investment is possible through:

- Exchange-traded funds (ETFs) focusing on rare earth and precious metals.

- Stocks of mining companies and tech firms innovating in these materials.

- Sustainable mining and recycling ventures.

For Career Seekers

Fields booming due to rare mineral demand include:

- Mining engineering and geology.

- Environmental science and sustainability.

- Materials science and chemical engineering.

- Recycling technology and waste management.

Many universities and government programs offer scholarships and training for these vital roles.

It’s Not Gold or Platinum: The World’s Priciest Mineral Is Something You’ve Never Heard Of

Sheep Wool Might Just Be the End of Cavities; Scientists Stunned by Tooth Regeneration Discovery