$264.41 Canadians Child Benefits October 2025: For thousands of Canadian families, the Canada Child Benefit continues to be a lifeline. With the cost of living climbing, monthly tax-free payments offer real relief, helping parents cover basic needs like childcare, housing, and school essentials. If you are a parent or caregiver, October 2025 brings another opportunity to receive this vital support—especially if your household income qualifies for the updated payment amount of up to $264.41 per child, depending on age and eligibility.

Now is the time to double-check if you meet the updated criteria and make sure your information with the Canada Revenue Agency is accurate. The Canada Child Benefit is not only income-based but also reflects your family size and your child’s age, making it important to stay informed.

Canada Child Benefit October 2025: Latest Payment and Eligibility

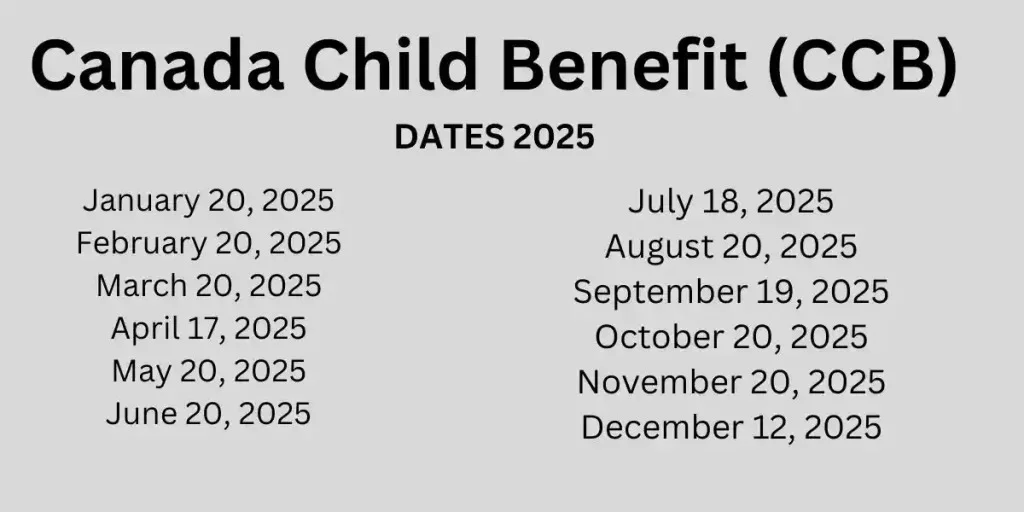

The Canada Child Benefit is a monthly financial assistance program for families raising children under 18. Administered by the CRA, this benefit adjusts every July to account for inflation and cost-of-living changes. For October 2025, the next CCB deposit will hit accounts on the 20th. This date is consistent for most recipients across provinces, provided that personal and banking information is up to date.

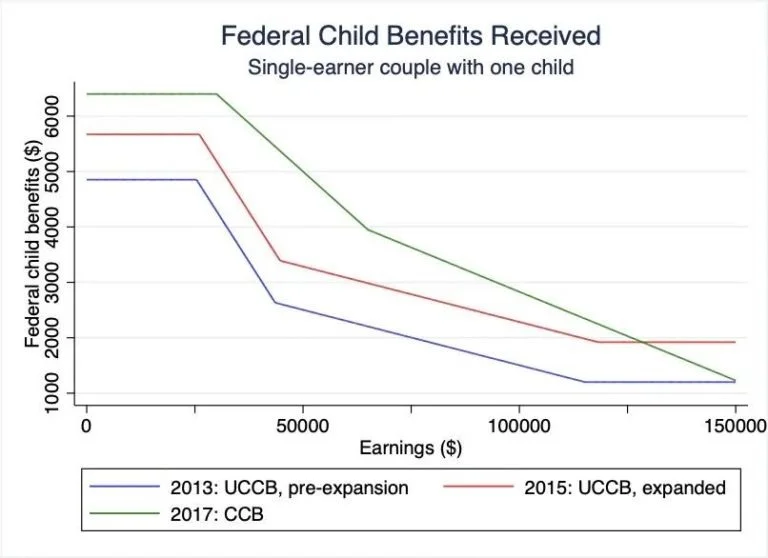

Families with lower annual incomes—particularly under $37,487—are eligible for the highest monthly amounts, but those with higher incomes may still receive a reduced payment. The amount you receive is based on your net income from your last tax return, your child’s age, and the number of children in your care.

Canada Child Benefit Overview Table – October 2025

| Detail | Information |

| October 2025 Payment Date | October 20, 2025 |

| Benefit Type | Tax-free monthly payment from CRA |

| Administered By | Canada Revenue Agency (CRA) |

| Eligibility Requirement | Children under 18, annual tax filing, residency in Canada |

| Max Annual Amount for Under 6 | $7,997 per child |

| Monthly Amount for Under 6 | $666.41 |

| Max Annual Amount for Ages 6 to 17 | $6,748 per child |

| Monthly Amount for Ages 6 to 17 | $562.33 |

| Shared Custody Payment Split | 50/50 between both parents |

| Payment Adjusted For | Inflation, family income, number of children, and child’s age |

October 2025 Payment Details

For October, families can expect their Canada Child Benefit to arrive on October 20. The amount varies from family to family. If your CRA details, such as your direct deposit info or address, are not up to date, the payment may be delayed. Make sure everything is correct in your CRA My Account to avoid issues.

The benefit is designed to help with child-related expenses and is directly deposited into the parent or guardian’s bank account each month. Parents of children with disabilities may also receive additional support through the Child Disability Benefit, processed alongside the regular CCB.

How CCB Amounts Are Calculated

Your CCB amount depends on your adjusted family net income, which is calculated from the previous year’s tax return. This means that even if your current financial situation has changed, your benefit for October is still based on your 2024 income.

The benefit also considers the number of children in the household and their ages. Families with children under six receive a higher monthly payment due to the added financial burden of early childhood care. Those with older children still qualify but at a slightly reduced rate.

Updated Rates for 2025-2026

The CRA updates the CCB each July to account for inflation. The maximum amounts for the 2025–2026 benefit year are:

- $666.41 per month for children under six

- $562.33 per month for children aged six to seventeen

These figures are for families earning under $37,487. If your income is higher, the CRA uses a phase-out formula to reduce the benefit amount gradually. Even families with income above $100,000 may still receive partial benefits.

Special Provisions and Shared Custody

If your child spends time with both parents separately, and custody is shared, each parent receives 50 percent of the Canada Child Benefit payment. This ensures fairness regardless of the exact time split.

In unfortunate circumstances where a child passes away, the CRA continues to issue the CCB and any related disability benefit for up to six months after the child’s death. This provides families with a bit of financial relief during an emotionally challenging time.

Importance of Filing Taxes

Filing your tax return each year is a non-negotiable requirement for receiving the Canada Child Benefit. Even if you earned no income, filing allows the CRA to calculate your eligibility. Missing a tax year could result in payment interruptions or loss of the benefit altogether.

Tax filing ensures the CRA has the most recent information on your income and family structure. If your family size changes due to a new birth, separation, or custody change, you should also report this as soon as possible through your CRA account or by calling their helpline.

Keeping Your Information Updated

To continue receiving your Canada Child Benefit without delays, it is crucial to keep your personal and financial information up to date with the CRA. This includes:

- Your address

- Your marital status

- Your banking information for direct deposit

- The number of children in your care

The easiest way to check and update this information is through the CRA’s online portal, My Account. You can also use the CRA mobile app for quick access and notifications regarding upcoming payments.

FAQs

The next CCB deposit is scheduled for October 20, 2025.

Families can receive up to $666.41 per child under six and $562.33 per child aged six to seventeen, depending on income.

No. However, you must file your taxes each year to remain eligible.

In shared custody situations, each parent receives 50 percent of the benefit amount.

CRA calculates your CCB based on your family’s net income, the number of children, and their ages.